China Futures: INE Medium Sour Crude Oil Futures

Did you know that the oil industry has been around for more than 150 years, but free trade in the international market only begun in the late 1960s?

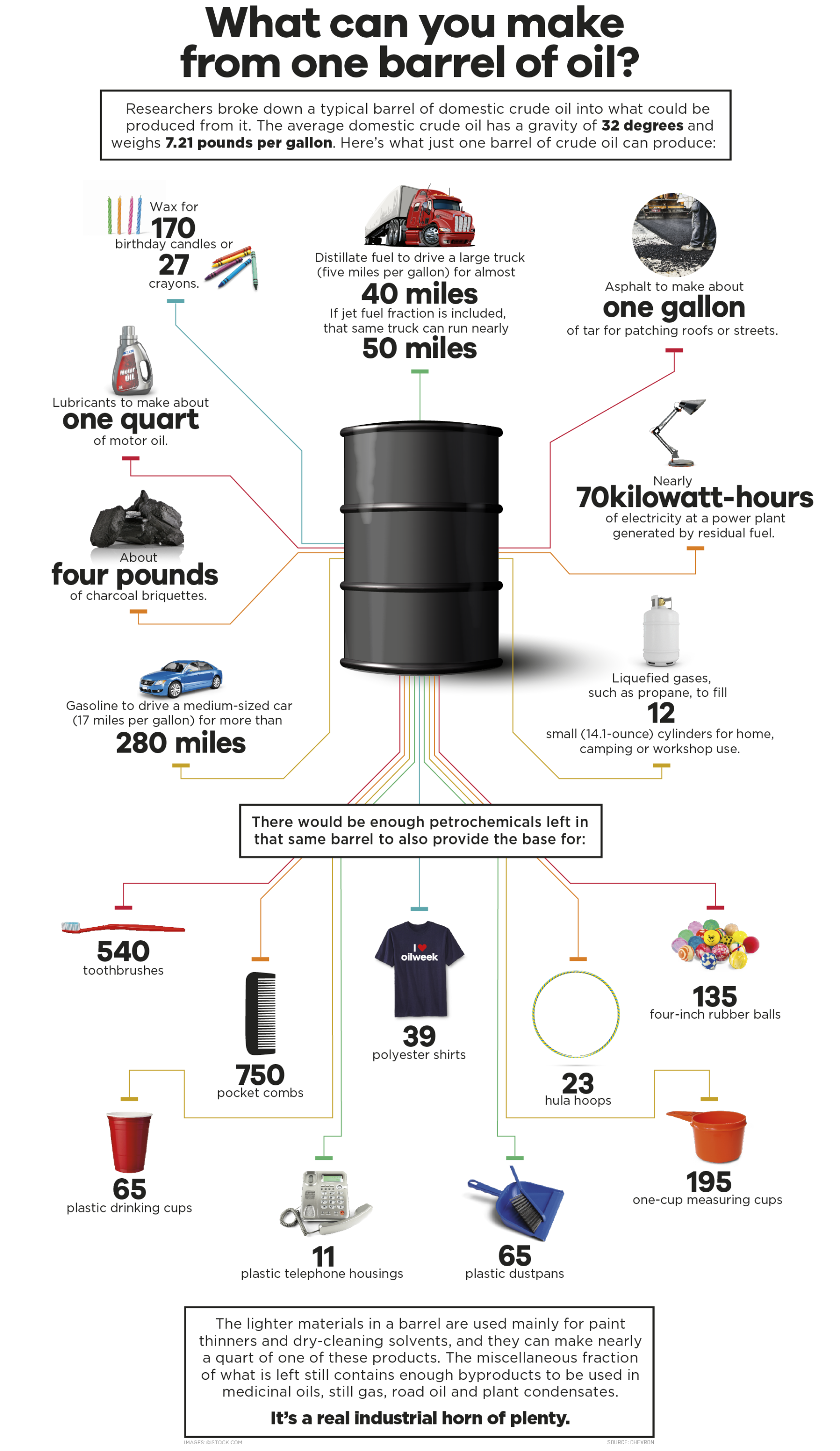

Crude oil is the most well-known commodity in the world. Besides being a major source of fuel, crude oil also produces many by-products from chemicals to plastics used in everyday life. It can be classified into “Sweet” or “Sour” depending on the Sulphur content.

What is Medium sour crude oil?

- Relatively abundant type of fossil fuel used worldwide.

- Its sulfur content is relativel high (over 1%)

- The Arabian Light Export and Kuwait Export Blend crude oils belong to this class.

Medium Sour Crude Oil Demand and Supply

- Demand-supply relationship of medium sour crude oil is unlike that of light sweet crude oil, due to its sulphur content and properties.

- Its output accounts for 44% of the global fuel output.

Crude Benchmarks

The three primary benchmarks for crude oil in the world are West Texas Intermediate (WTI), Brent Blend, and Dubai Crude.

- West Texas Intermediate is used primarily in the U.S. It is light (API gravity) and sweet (low-sulfur)

- Brent Crude is a mix of crude oil from 15 different oil fields in the North Sea. It is the benchmark used primarily in Europe

- Dubai Crude, also known as Fateh, is a heavy sour crude oil extracted from Dubai.

- Currently, there is no authoritative benchmark for medium sour crude oil on the international market

Potential of the INE (Shanghai International Energy Exchange) Medium Sour Crude Oil Futures Contract:

- It is the main type of crude oil imported by China and within Asia Pacific.

- While there have been other crude oil benchmark prices in Europe & America, they cannot accurately reflect the demand-supply relationship in Asia-Pacific.

- This is the first product on the Chinese futures market that allows international participation.

- This contract is a tool that allows market participants to either hedge or arbitrage using the crude oil futures, effectively protecting against price risk.

Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

To learn how to participate in the INE Medium Sour Crude Futures: Click here

For Contract Specifications of the INE Medium Sour Crude Futures: Click here

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange) which means our clients get direct access to the China markets. Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

Have a question? You may access our Frequently Asked Questions here, or click the button below to message us.

To open an Account, click the button below.

Sources

https://blogs.platts.com/2014/10/03/brent-wti-gsci/

http://www.ine.cn/en/products/oil/manual/manual/

Picture Credit : Courtesy of: Visual Capitalist