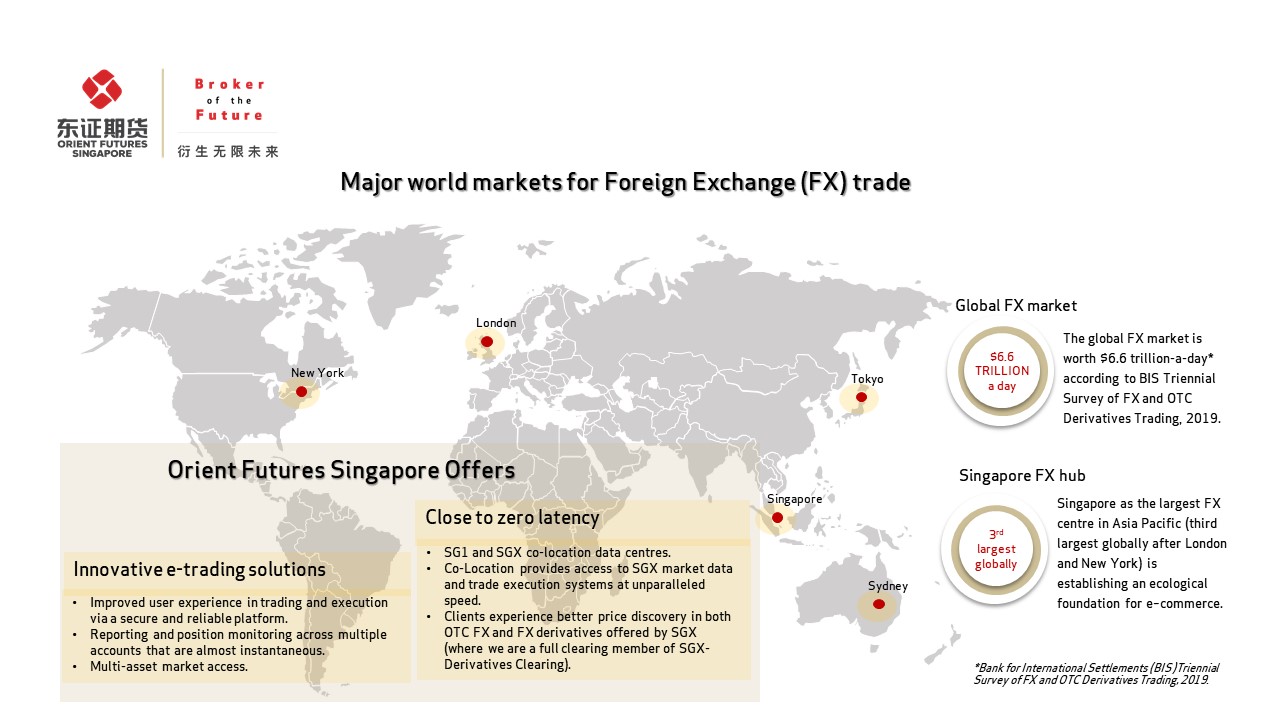

Singapore is the largest foreign exchange (FX) centre in Asia Pacific, the third largest globally after London and New York, in the global $6.6 trillion-a-day* FX market. As trading volumes continue to increase in Singapore’s FX market, there are ongoing efforts by the Monetary Authority of Singapore (MAS) to strengthen Singapore’s position as a regional FX e-trading hub.

The demand for interconnection continues to rise, as Singapore forges ahead with its plans to advance its FX industry. With interconnectivity measured down to the millisecond, interconnection quality and technology are vital edges in trading. Orient Futures Singapore is here to play an active role in this ecosystem by offering leading-edge interconnectivity and innovative e-trading solutions.

Close to zero latency:

- Working with our partners, Orient Futures Singapore offers leading connectivity, enabling instant access to key financial markets in the region. This is achieved via the high-performance, low latency infrastructure in SG1 datacenter.

- Close to zero latency between SG1 and SGX co-location data centres. Co-Location provides access to SGX market data and trade execution systems at unparalleled speed. Hence it enables our clients to experience better price discovery in both OTC FX and FX derivatives offered by SGX (where we are a full clearing member of SGX-Derivatives Clearing).

Innovative e-trading solutions:

- Improved user experience in trading and execution via a secure and reliable platform which utilises advanced technology.

- Reporting and position monitoring across multiple accounts that are almost instantaneous.

- Multi-asset market access.

For enquiries on our services, kindly send your emails to support@orientfutures.com.sg or simply contact us.

*Bank for International Settlements (BIS) Triennial Survey of FX and OTC Derivatives Trading, 2019.