About Peanut Kernel Futures

Peanut kernels are an important commodity in global agricultural trade. Their versatility extends beyond the realm of culinary delight, finding applications in the food industry, animal feed, and more.

In January 2022, Zhengzhou Commodity Exchange (ZCE) introduced Peanut Kernel futures and options as part of China's internationalized products. This initiative enables international traders to access these Chinese commodity futures and options, among other domestic commodities.

The extensive use of Peanut Kernel makes ZCE Peanut Kernel Futures one of the most actively traded futures contracts in the global market.

In this article, we dive into the updates and news regarding ZCE Peanut Kernel Futures.

Click to Learn more about 5 Things to Know About Trading Peanut Kernel Futures and Peanut Kernel and Rough Rice Futures September Updates.

ZCE Peanut Kernel Futures

International traders can access Peanut Kernel Futures and Options from the Zhengzhou Commodity Exchange (ZCE) through the QFI China Scheme or other internationalized products from China.

To trade in the Chinese market, such as ZCE Exchange, global traders are required to go through an overseas intermediary, such as Orient Futures International Singapore.

Orient Futures International Singapore is a Singapore Forex broker that provides convenient access to China Futures Market for international traders. This allows international traders to use US dollars and offshore RMB to meet the initial trading margin requirements and trade without incurring Chinese taxes.

Orient Futures Singapore also provides access to other Chinese trade exchanges such as Shanghai International Energy Exchange (INE) and Dalian Commodity Exchange (DCE China). This includes commodities futures such as DCE LLDPE Futures, ZCE PTA Futures, INE Crude Oil Futures, Soybean meal Soybean Oil Futures, and more.

ZCE Peanut Kernel Futures Contract Specification

The ZCE Peanut Kernel Futures Contract has the following specifications:

The ZCE Peanut Kernels Futures Contract has a minimum price fluctuation of CNY 2/metric ton.

Contract months are January, March, April, October, November, and December

The last trading day of the contract month is the 10th trading day of the delivery month.

Zhengzhou Commodity Exchange trading hours are from Monday to Friday, at these trading hours:

Monday to Friday (except public holidays)

9:00 a.m.-11:30 a.m. 1:30 p.m.-3:00 p.m. (Beijing time)

ZCE Peanut Kernel Futures symbol: PK

Peanut Kernel Market News

Peanut Kernel Supply and Demand

According to CN Gold, the current season is witnessing a substantial increase in the supply of new peanuts in China. However, due to rainy weather, peanuts from the Henan province have experienced delays in harvest and market entry.

In contrast, the northeastern production areas in China are enjoying favourable weather conditions, leading to a relatively rapid market entry of new peanuts.

On the demand side, many traders are making purchases on an as-needed basis. As the supply gradually becomes clearer, the market's attention will shift to demand, especially the demand from oil processing plants.

In recent times, domestic oilseed meal prices have continued to weaken, resulting in a relatively weak profit margin for peanut crushing in the spot market. This has affected the enthusiasm of oil processing plants for purchasing.

After China’s long holiday period, major domestic oil plants, such as Lu Hua, are expected to gradually enter the market. Given that oil processing plants still have replenishment needs, it is crucial to monitor whether the declining trend in the market will slow down. In the medium term, the focus will be on changes in spot crushing margins and the enthusiasm of oil processing plants for procurement.

ZCE Peanut Kernel Price

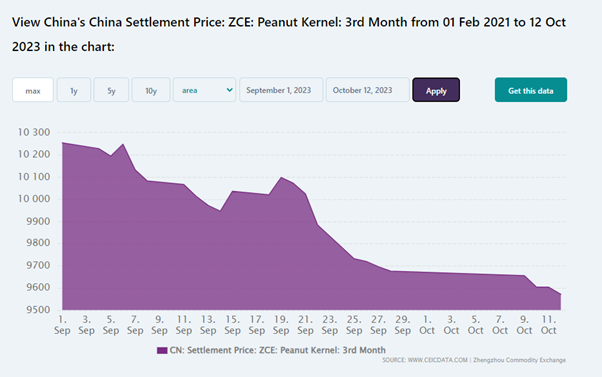

Figure 1. ZCE Peanut Kernel Price Chart Market Data from Ceicdata

According to Ceicdata, ZCE Peanut Kernel Futures were priced at 9,572 RMB/Ton on October 12, 2023, which marks a decrease from the previous day's price of 9,604.000 RMB/Ton.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.