Financial

*During an inspection tour in Hubei and Hunan provinces, China’s Vice Premier He Lifeng stressed the need to continuously promote the quality and efficiency of foreign trade and remove systemic blockages hindering the development of a unified national market.

Industrial Economy

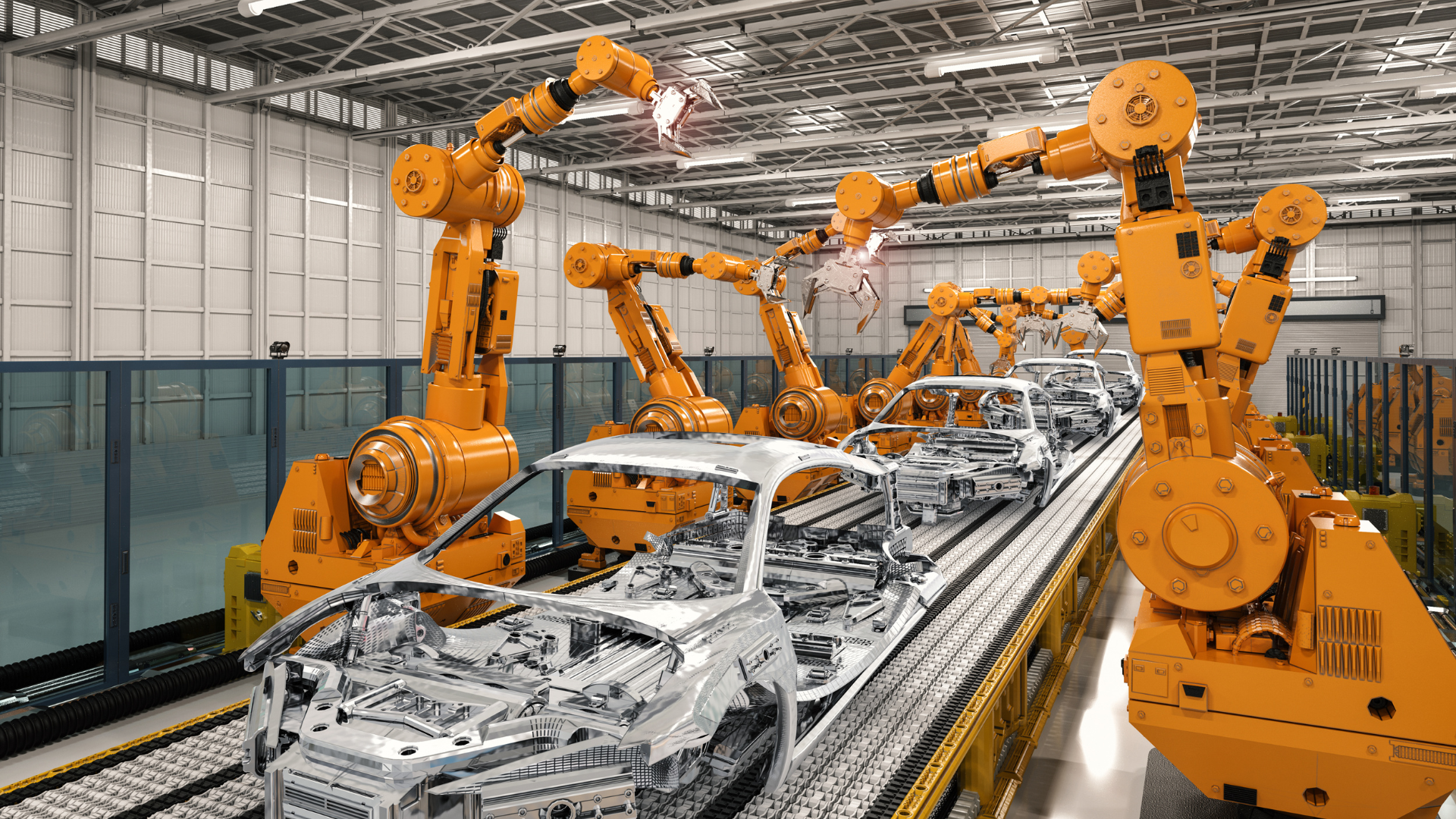

*Guangdong Province issued the “Guangdong National Digital Economy Innovation and Development Pilot Zone Construction Implementation Plan (2025-2027)”, which actively promotes the innovative development of the AI and robotics industries. By 2027, the core AI industry scale is expected to exceed 440 billion yuan, with computing power surpassing 60 EFLOPS.

*The China Industrial Association of Power Sources (CIAPS) will issue a “Notice on Referencing the LFP Cost Index and Regulating Industry Development”, which will recommend setting a cost baseline to standardize pricing, a move aimed at combating vicious competition within the lithium iron phosphate sector.

*MoF and MIIT drafted and publicly solicited opinions on the “Procurement Requirements Standard for New Energy Vehicles”.

Co Focus

*Moore Threads announced that the issuer and the lead underwriter have determined the final offer price at 114.28 yuan per share based on the preliminary bookbuilding results. A cumulative bidding inquiry for the offline offering will not be conducted.

Nov 20 Block Trade Info

*Discount

-SICC (688234 CH) saw 15 block trades worth 128.63mn at 70.00yuan per share, 12.48pct discount from last closing.

-Bestlink Tech (603206 CH) saw 5 block trades worth 71.45mn at 14.98yuan per share, 9.16pct discount from last closing.

-Zhongji Innolight (300308 CH) saw 4 block trades worth 759.29mn at 469.86yuan per share, 4.50pct discount from last closing.

-Sichuan Shuangma (000935 CH) saw 6 block trades worth 91.91mn at 19.02yuan per share, 11.66pct discount from last closing.

For more insights, please visit Orient Futures Singapore’s research platform, Finoview.