On 16 July 2025, Orient Futures Singapore, in collaboration with Cboe Global Markets and Trading Technologies, hosted an exclusive event titled “Unlock Cboe Options Opportunities: Data-Driven Solutions for Traders.” The session brought together leading voices in the derivatives and market data landscape to explore the evolving U.S. options market and the powerful tools now available to traders in the Asia Pacific region.

The State of the U.S. Options Landscape

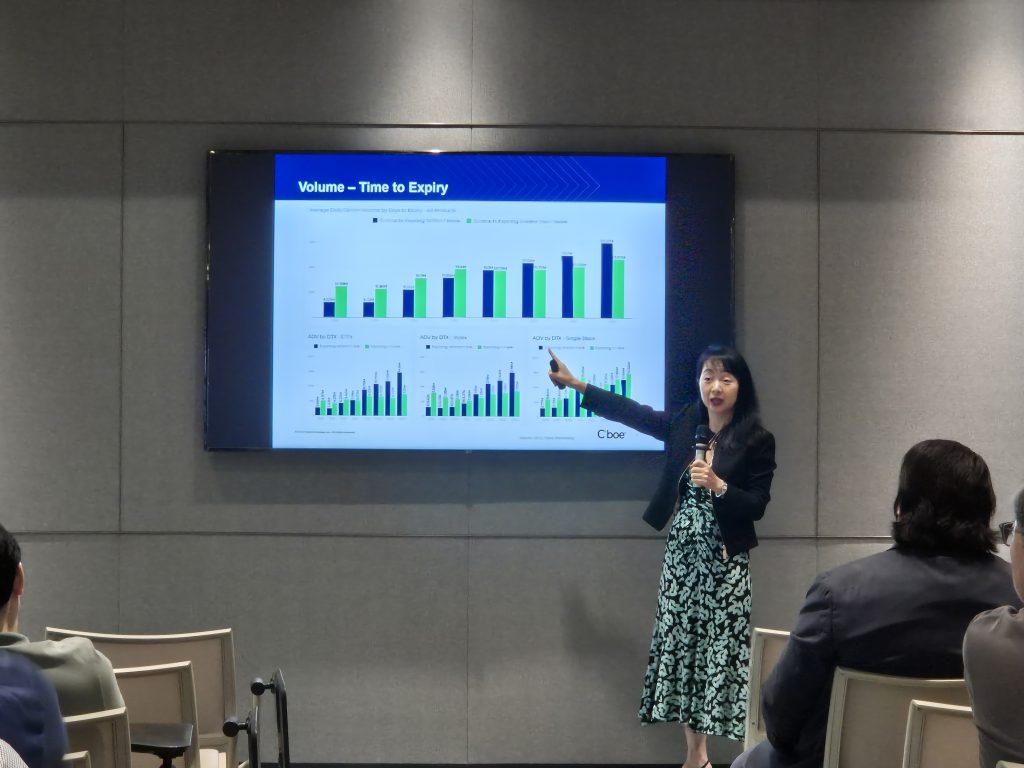

Wei Liao from Cboe Global Markets, opened the session with a comprehensive analysis of the U.S. options market, focusing on recent trends, growth dynamics, and shifting trader behaviours. In particular, Liao emphasised the meteoric rise of SPX options and Zero Days to Expiration (0DTE) options, which have rapidly become focal points for institutional investors.

Unlocking the Power of Market Data

Following Liao’s market overview, Adrian Griffiths from Cboe Global Markets, provided an in-depth look at the suite of Cboe Market Data products. He highlighted how real-time and historical data offerings are empowering traders to build smarter strategies and react more swiftly to market events.

Griffiths also introduced Cboe Data Vantage, a product designed to give users a competitive edge through granular analytics, seamless integration, and actionable insights derived from Cboe’s deep market datasets.

Enabling Smarter Execution with Technology

Bringing a technology-driven perspective to the discussion, Terence Ang from Trading Technologies, showcased how the TT® platform integrates seamlessly with Cboe’s data ecosystem. He discussed how Trading Technologies is supporting sophisticated options trading strategies through powerful execution tools, data visualisation, and customisable workflows.

A Strategic Collaboration for APAC Traders

The event marked a strategic effort by Orient Futures Singapore to bridge global market opportunities for traders in Asia Pacific, enabling access to the full potential of Cboe’s options markets through robust data and execution tools.

With the combination of Cboe’s deep market intelligence and Trading Technologies’ advanced trading solutions, the session offered attendees a unique glimpse into how U.S. options markets can be navigated with greater precision and confidence.

Start Trading with Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us, opening additional trading avenues.

Expect streamlined processes and an easy-to-use interface designed for minimal latency, accompanied by our team’s round-the-clock availability on trading days to provide assistance for all your trading needs.