Reading Time: 2 minutes

How Overseas Institutions and Individuals can participate in INE Futures Contract

How can overseas institutions and individuals access and trade in the Futures Contracts that has been internationalised and opened up for global trading, namely the following contracts on the INE (Shanghai International Energy Exchange):

INE Crude Oil Futures including

INE Copper Carthode Futures (from 19 Nov 2020)

How Overseas Institutions and Individuals can participate in INE Futures Contract

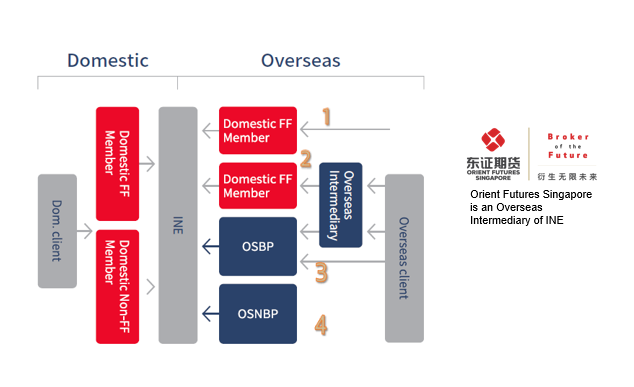

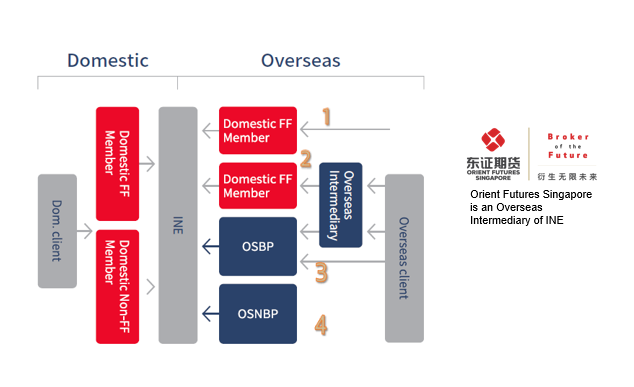

1. Global clients may trade through a domestic Futures Firm Member (FF Member) of INE;

2. An INE-recognized Overseas Intermediaries may help its global customers execute and clear trades through a carrying broker, either a domestic FF Members or an Overseas Special Brokerage Participant (OSBP) of INE;

3. An INE OSBP having direct trading access on the Exchange may help their global clients execute trades on the Exchange but clear and settle trades through its contracted carrying broker, who must be an INE’s FF Member;

4. Being an Overseas Special Non-Brokerage Participants (OSNBP) of INE that trades directly on the Exchange but clear and settle trades through its contracted carrying broker, who must be an INE's FF Member.

- Grey arrows indicate direct access of trading, clearing and settlement.

- Blue arrows indicate direct access of trading, but clear and settle trades through a carrying broker who must be a domestic FF Member.

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange) which means our clients get direct access to the China markets.

Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.