Qualified Foreign Institutional Investor list (QFI China)

A list of QFIIs is provided by the CSRC and updated in 2020.

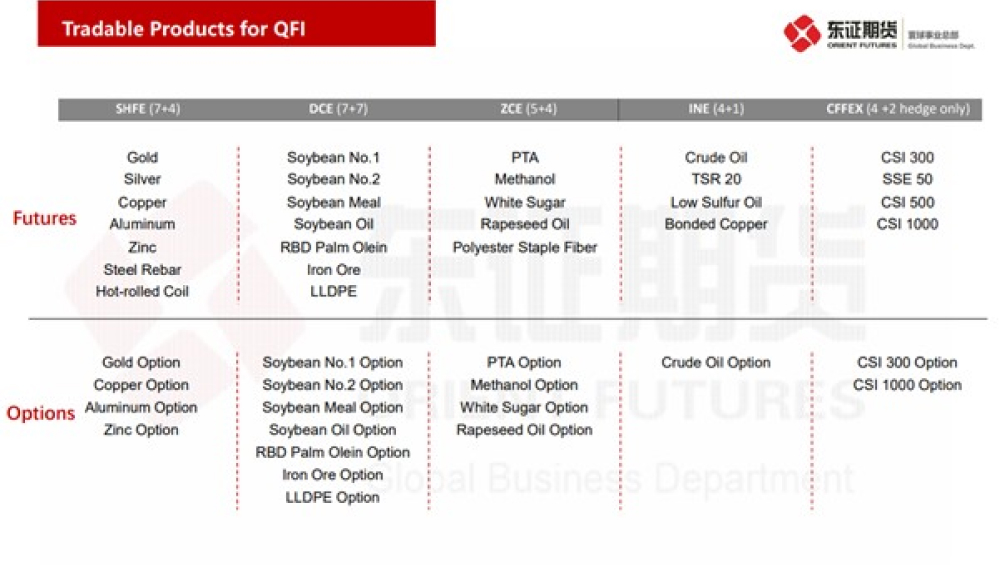

Orient Futures Singapore offers the following Products from 5 Chinese futures exchanges. These products offer price discovery and a larger range of tradable products.

-

Shanghai International Energy Exchange (INE)

- Crude Oil Futures

- TSR20 Rubber Futures

- Low-Sulfur Fuel Oil Futures

- Copper Futures – since 19 Nov 2020

- Crude Oil Options – since 21 Jun 2021

-

Dalian Commodity Exchange (DCE)

- Iron Ore Futures

- Iron Ore Options

- Palm Olein Futures

- DCE Palm Olein Options

- No1. Soybean

- No1. Soybean Options

- No2. Soybean

- No2. Soybean Options

- Soybean Meal

- Soybean Meal Options

- Soybean Oil

- Soybean Oil Options

- LLDPE

- LLDPE Options

-

Zhengzhou Commodity Exchange (ZCE)

- Purified terephthalic acid (PTA) Futures

- Methanol Futures

- Methanol Options

- White Sugar Futures

- White Sugar Options

- Rapeseed Oil

- Rapeseed Oil Options

- Rapeseed Meal

- Rapeseed Meal Options

- Peanut Kernels

- Peanut Kernels Option

-

Shanghai Futures Exchange (SHFE)

- Gold Futures

- Silver Futures

- Copper Futures

- Aluminum Futures

- Zinc Futures

- Steel Rebar

- Hot-Rolled Coil

- Gold Option

- Copper Option

- Aluminum Option

- Zinc Option

-

CFFEX

- CSI 300

- SSE 50

- CSI 500

- CSI 1000

- CSI 300 Option

- CSI 1000 Option

Your Ideal Partner for China Markets – Orient Futures Singapore

Overseas Intermediary

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange), Dalian Commodity Exchange and Zhengzhou Commodity Exchange.

Direct Access

When foreign clients participate in these internationalized futures contract with us, they have direct access in trading, clearing and settlement.

Strong Backing in China

We are backed by strong resources from our parent company Shanghai Orient Futures, who is the largest broker in term of aggregated volume among the five regulated exchanges in China.

Shanghai Orient Futures Co., Ltd. is a direct wholly owned subsidiary of Orient Securities Co., Ltd., approved by the China Securities Regulatory Commission as a comprehensive futures brokerage firm to offer commodity futures brokerage, financial futures brokerage, futures investment consulting, asset management, fund sales and other businesses. It has a registered capital of 2.3 billion yuan and memberships in the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, and Shanghai International Energy Exchange.

Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.