Gain access to China’s Futures and Options Market

Orient Futures Singapore offers the following products from three internationalised futures exchanges. These products offer good price discovery, arbitrage and hedging opportunities.

-

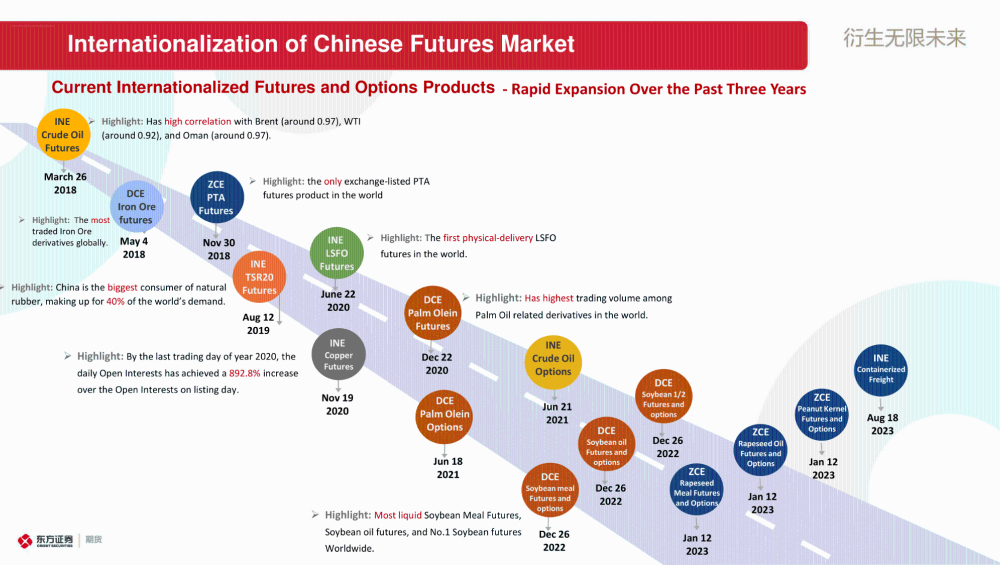

- Shanghai International Energy Exchange (INE)

- Crude Oil Futures

- TSR20 Rubber Futures

- Low-Sulfur Fuel Oil Futures

- Copper Futures – since 19 Nov 2020

- Crude Oil Options – since 21 Jun 2021

- NEW: Containerized Freight Index Futures – Since 18 Aug 2023

- Dalian Commodity Exchange (DCE)

- Iron Ore Futures

- Palm Olein Futures – since 22 Dec 2020

- DCE Palm Olein Options – since 18 Jun 2021

- No1. Soybean – since 26 Dec 2022

- No1. Soybean Options – since 26 Dec 2022

- No2. Soybean – since 26 Dec 2022

- No2. Soybean Options – since 26 Dec 2022

- Soybean Meal – since 26 Dec 2022

- Soybean Meal Options – since 26 Dec 2022

- Soybean Oil – since 26 Dec 2022

- Soybean Oil Options – since 26 Dec 2022

- Shanghai International Energy Exchange (INE)

- Zhengzhou Commodity Exchange (ZCE)

-

- Purified terephthalic acid (PTA) Futures

- NEW: Rapeseed Oil – since 12 Jan 2023

- NEW: Rapeseed Oil Options – since 12 Jan 2023

- NEW: Rapeseed Meal – since 12 Jan 2023

- NEW: Rapeseed Meal Options – since 12 Jan 2023

- NEW: Peanut Kernels – since 12 Jan 2023

- NEW: Peanut Kernels Option – since 12 Jan 2023

-

Your Ideal Partner for China Markets – Orient Futures Singapore

Overseas Intermediary

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange), Dalian Commodity Exchange and Zhengzhou Commodity Exchange.

Direct Access

When foreign clients participate in these internationalized futures contract with us, they have direct access in trading, clearing and settlement.

Strong Backing in China

We are backed by strong resources from our parent company Shanghai Orient Futures, who is the largest broker in term of aggregated volume among the five regulated exchanges in China.

Shanghai Orient Futures Co., Ltd. is a direct wholly owned subsidiary of Orient Securities Co., Ltd., approved by the China Securities Regulatory Commission as a comprehensive futures brokerage firm to offer commodity futures brokerage, financial futures brokerage, futures investment consulting, asset management, fund sales and other businesses. It has a registered capital of 2.3 billion yuan and memberships in the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, and Shanghai International Energy Exchange.

Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.