About ICE NYBOT Coffee Futures

Coffee is a versatile and cherished commodity with applications ranging from comforting brews to intricate culinary delights. Beyond being a beloved morning ritual, coffee futures are also one of the most actively traded futures contracts in the global commodities market due to its multiple applications in the world.

Coffee C Futures, managed by the Intercontinental Exchange (ICE Futures US) and housed within the New York Board of Trade (NYBOT), are the world’s benchmark for Arabica coffee.

Apart from Arabica Coffee Futures, ICE Futures US also offers NYBOT Sugar Futures (Sugar No.11 Futures), NYBOT Cotton Futures (Cotton No.2 Futures), NYBOT Cocoa Futures, and more. Traders can trade these Futures contracts through Orient Futures International Singapore.

Apart from ICE, Orient Futures Singapore also offers other commodity futures in the futures market such as CME Coffee Futures, white sugar futures, soybean futures, rapeseed futures from other exchanges. This includes Dalian Commodity Exchange (DCE China), Shanghai International Energy Exchange (INE China), Zhengzhou Commodity Exchange (ZCE), Singapore Exchange Derivatives Trading Limited (SGX) and more.

ICE Futures US NYBOT Coffee Contract Specifications

The ICE Futures US NYBOT Coffee Futures Contract has the following specifications:

The Futures Contract has a minimum price fluctuation of 5/100 cent/lb., equivalent to $18.75 per contract.

Contract months are March, May, July, September, and December

The last trading day of the contract month is one business day prior to last notice day.

NYBOT Trading Hours are 3:15 am – 12:30pm CST

Arabica Coffee Futures Symbol: KC

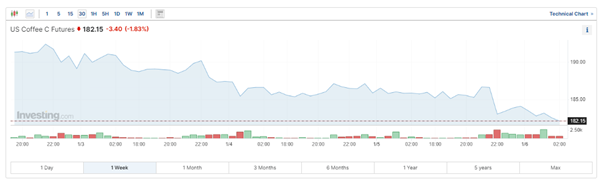

NYBOT Coffee Price Drops 3%, Hits One-Month Low

ICE NYBOT Coffee Future News

According to Reuters, ICE NYBOT Arabica coffee futures prices reached a one-month low on 5th January 2024, ending the week with a net loss of 3%. This decline was influenced by commodities index rebalancing and the anticipation of rains in Brazil, which is a major coffee-producing region.

March arabica coffee (KCc1) settled down 2.75 cents, or 1.5%, at $1.828 per lb, hitting a one-month low at $1.820. The observed selling of arabica coffee futures by funds is likely tied to the rebalancing of commodity indexes in January.

The weather in Brazil continues to be mostly positive for crop development, contributing to a steady export flow. In December, Brazil’s green coffee exports surged by 33% compared to the previous year, reaching 4.06 million bags.

On the other hand, March robusta coffee bean (LRCc2) experienced a 0.3% rise, reaching $2,795 per metric ton. Despite gains in the previous session, the robusta beans contract faced a 2% decline for the week.

Dealers suggest that prices might need to increase further to incentivize regular selling by farmers in Vietnam, another key producer. Exporters are grappling with delivery delays from farmers.

Arabica Coffee Futures Prices

According to Investing.com, ICE Coffee Futures are priced at USD $182.15 per lb, as of 8th January 2024.

ICE NYBOT Coffee Futures Price Forecast 2024

According to Investing Haven, the global coffee production forecast for 2023/2024 is set to rise. World coffee production is expected to increase by 4.3 million bags (60 kilograms) compared to the previous year, reaching 174.3 million. The higher output in Brazil and Vietnam is anticipated to more than offset the reduced production in Indonesia.

With additional supplies, global exports are projected to increase by 5.8 million bags to a record 122.2 million, primarily driven by strong shipments from Brazil. Despite a forecasted record global consumption of 170.2 million bags, ending inventories are expected to remain tight at 31.8 million bags.

Investing Haven predicted that coffee prices will rise due to the stronger Real. This is due to coffee being predominantly traded in dollars on international markets.

The strengthened Real reduces the value of coffee, providing traders in Brazil with an incentive to limit sales in international markets in anticipation of higher prices. Consequently, the availability of coffee in external markets decreases, exerting an upward pressure on prices.

东证期货国际(新加坡)简介

我们是 上海东证期货有限公司的直属全资子公司, 也是东方证券股份有限公司的间接控股子公司。

作为持有新加坡金融管理局(MAS)颁发的《资本市场服务许可证》的机构, 我们也是新交所、 亚太交易所和, 洲际(新加坡)交易所的会员。

我司提供 premium customer service at an affordable cost to all our clients. Our team will 场内衍生品、 及杠杆外汇等多类产品。