China’s Futures Market

The Chinese economy’s large size and fast growth makes it a major player in the global economy. With a population exceeding 1.4 billion and a rich tapestry of industries spanning manufacturing, technology, finance, and beyond, China’s economic prowess is undeniable. Among these, China’s futures market plays a crucial role in the country’s economy.

China’s futures market offers access to a wide range of commodities, including agricultural products, metals, and energy resources. These commodities are crucial for global trade and consumption, making their futures contracts attractive to investors seeking to hedge against price fluctuations or speculate on future price movements.

With the introduction of the QFI Scheme and the Internationalized Products from the Chinese government, foreign investors can now access the Chinese Futures Market through overseas intermediaries, such as Orient Futures Singapore.

Foreign traders can utilize this to hedge against price fluctuations in essential commodities in China. This would benefit the Chinese futures market by attracting foreign investment inflows. This influx enhances market liquidity and depth, making it more efficient and attractive for domestic participants.

Foreign participation in China’s futures market can also contribute to the internationalization of the Chinese yuan (renminbi), China’s currency. Foreign investors trading in yuan futures contracts would boosts the currency’s use in global trade and finance. This strengthens China’s role as a major player in the global economy.

Brief Summary on Futures Market of China

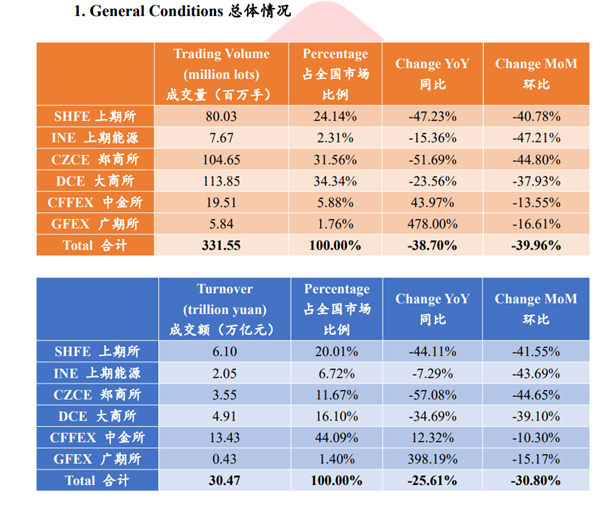

Figure 1. Report on Futures Market of China in February 2024 by Orient Futures Shanghai Research Team.

According to the Report on Futures Market of China in February 2024 by the Orient Futures Shanghai Research Team, the latest statistical data released by the China Futures Association shows that in February 2024, the trading volume of the national futures market was 331.55 million lots, down 38.70% YoY and 39.96% MoM. The turnover of the national futures market was 30.47 trillion yuan, down 25.61% YoY and 30.80% MoM.

QFI China and Internationalized Products

Introduced in 2013, the Qualified Foreign Investor (QFI Scheme) is a collective regime that includes Qualified Foreign Institutional Investor (QFII) and RMB Qualified Foreign Institutional Investor (RQFII) schemes, which merged into one.

The merger and relaxed China QFII rules make it easier for foreign traders to apply and invest in China’s trading market. This one-time application comes with relaxed entry criteria and simplified application documents. All these also comes with a reduced approval time once the application documentation fulfils China Securities Regulatory Commission (CSRC) requirements.

China expanded the range of onshore derivatives available to foreign traders and QFIs on November 21, 2021. It aims to provide more trading opportunities for foreign traders in the Chinese market.

The QFI scheme allows investors to trade commodity futures, commodity options, and stock index options.

Benefit of QFI China Scheme

Introduced in 2013, the Qualified Foreign Investor (QFI) scheme simplifies the application process for international traders looking to invest in China’s trading market. This scheme enables international traders to participate in China’s derivative market, facilitating investment opportunities. This includes cross-arbitrage trading, such as refined copper arbitrage trading and rubber arbitrage trading.

Click to find out 3 Reasons To Invest in China and QFI China Scheme.

QFI China And China Internationalised Products Updated List

China offers many different derivative futures and options products under the QFI Scheme and Internationalized Products. This includes Dalian Commodity Exchange Soybean Futures, Zhengzhou Commodity Exchange ZCE PTA Futures, Shanghai International Energy Exchange INE Crude Oil Futures (Chinese crude oil futures) and more.

In addition, Shanghai International Energy Exchange (INE China) has also launched the new Containerized Freight Index Futures Contracts (Europe Service) on 18th August 2023. The SCFIS is an index for sea freight rates for imports from China worldwide. It is an indicator of freight prices for container transport from Chinese ports.

Read to find out more:

INE China Launches New Containerized Freight Index Futures

Shanghai Containerized Freight Index Futures 2024 New Updates

Click to see the Full Updated QFI China And China Internationalised Products List.

How to Access China’s Derivatives Futures Market?

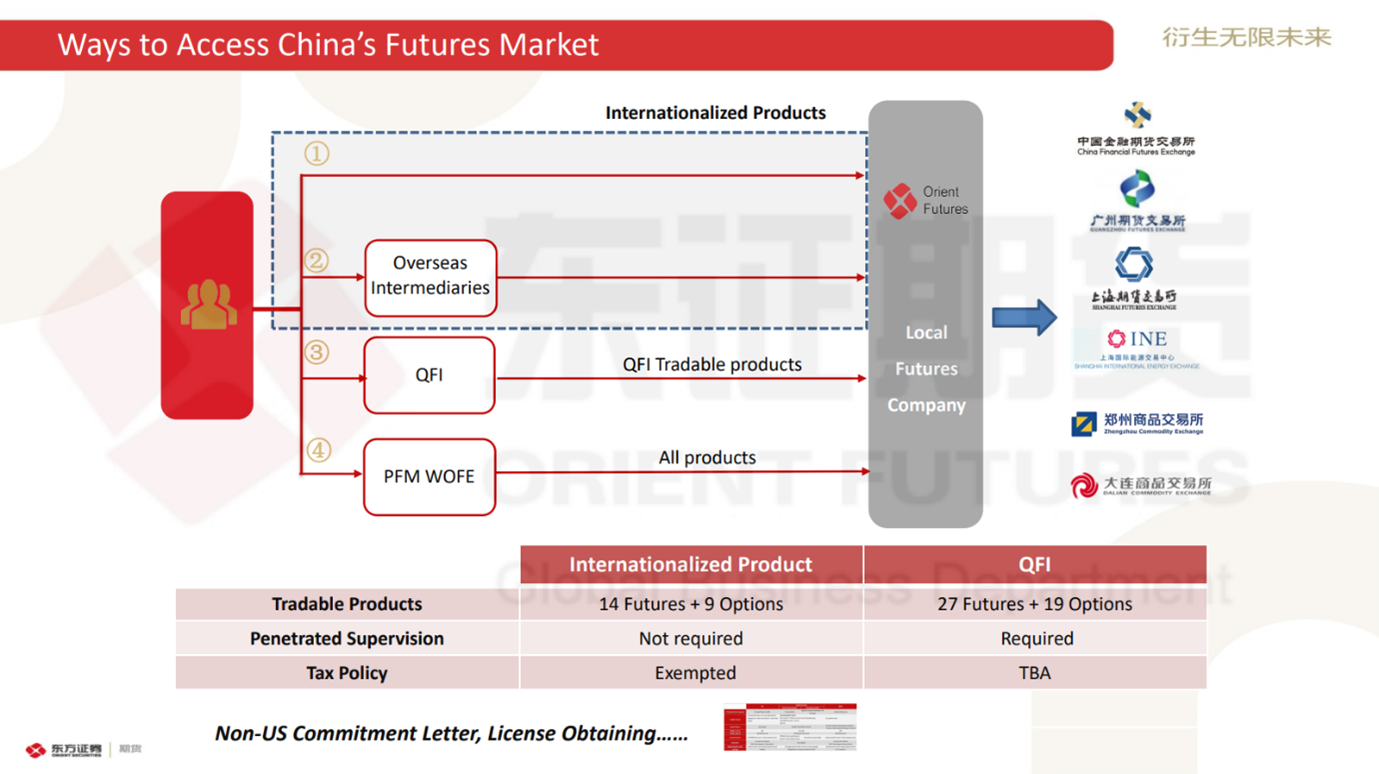

Figure 2. Source: Orient Futures Shanghai: Ways to Access China Futures Market

Access to China’s Futures market has been made more accessible with the diversification of schemes. As shown in the above diagram from Orient Futures Shanghai, traders can choose to trade through overseas intermediaries (Orient Futures International Singapore), QFI (Qualified Foreign Investor) schemes, or PFM WOFE. Currently, there are 14 futures and 9 options available in the internationalized product schemes, 27 futures, and 19 options available in the QFI scheme.

Importance of Using a Regulated Broker

Orient Futures International Singapore is a trusted Singapore forex and futures trading broker. We are proud to hold a Monetary Authority of Singapore (MAS) Capital Markets Services (CMS) Licence, which reaffirms our commitment to adhering to the highest standards of financial regulation and security. We provide access to various futures and stock exchanges.

东证期货国际(新加坡)简介

东证期货国际(新加坡)私人有限公司是上海东证期货有限公司的直属全资子公司,也是东方证券股份有限公司的间接控股子公司。

作为持有新加坡金融管理局(MAS)颁发的《资本市场服务许可证》的机构,我司提供全方位资本市场服务,涵盖证券、场内衍生品、场外衍生品及杠杆外汇等多类产品。

东证期货新加坡是亚太交易所、新加坡衍生品交易所以及洲际新加坡交易所的交易和清算会员,为客户提供覆盖国际市场的综合交易服务。