As China’s derivatives market continues to flourish on the global stage, an increasing number of traders are seeking access to the Chinese market.

Traders that would like to access China’s Derivatives Market, can look to do so through Orient Futures International (Singapore) Pte Ltd (“Orient Futures Singapore”).

东证期货国际(新加坡)简介

Orient Futures Singapore is an award-winning overseas broker for the Chinese Derivatives Market. It was awarded with the “年度最佳中资期货公司” (Chinese Futures Commission Merchant (FCM) of the Year) 及 “年度最佳非银行期货经纪商”大奖(Non-Bank FCM of the year), 再创佳绩!

Orient Futures Singapore is a regulated forex broker under the Monetary Authority of Singapore (MAS), and currently holds memberships at the 我们也是新交所、 亚太交易所和, 洲际(新加坡)交易所的会员。 自2023年8月,企业客户可通过东证期货新加坡 进入巴西交易所, 享无限机遇。

Backed by one of the largest brokerage firms in China, Shanghai Orient Futures, Orient Futures Singapore is committed to offering an expansive and varied trading experience for our esteemed clients.

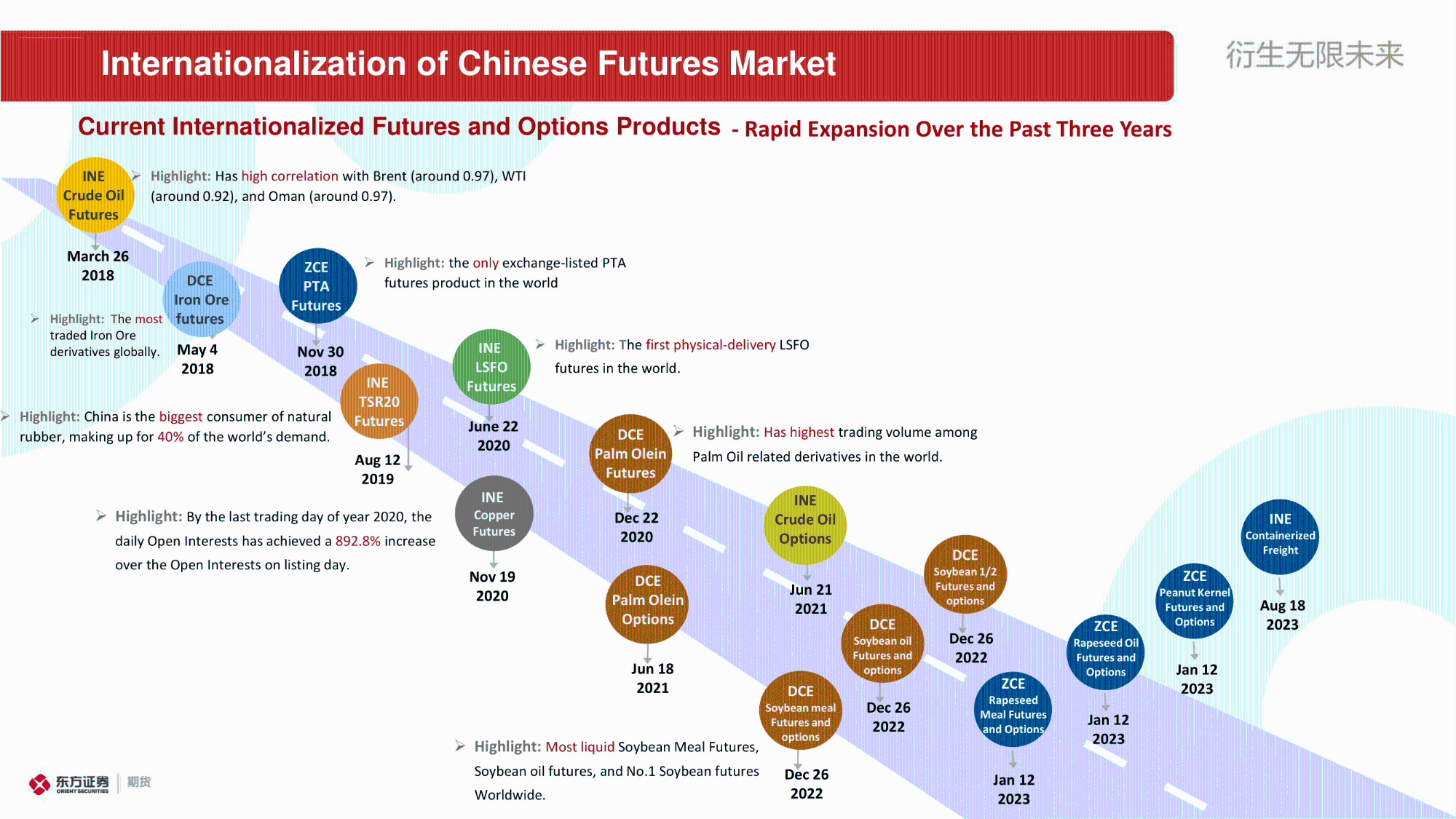

Figure 1. Internationalised Products from ZCE, DCE and INE that Traders can trade through Orient Futures Singapore

Orient Futures Singapore is an Overseas Broker for ZCE, DCE, and INE

我们是 Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), Orient Futures International Singapore allows International clients to have direct access to trading, clearing, and settlement, when they participate in internationalised futures contracts in these Chinese markets through us.

Orient Futures Singapore enables International Traders to access the China Derivatives Market through either the QFI China Scheme or Internationaliszed Products.

Orient Futures Singapore offers the following products from three Chinese exchanges. These products offer good price discovery, arbitrage, and hedging opportunities.

-

Shanghai International Energy Exchange (INE)

- Crude Oil Futures

- TSR20 Rubber Futures

- Low-Sulfur Fuel Oil Futures

- Copper Futures – since 19 Nov 2020

- Crude Oil Options – since 21 Jun 2021

- NEW: Containerized Freight Index Futures – Since 18 Aug 2023

-

Dalian Commodity Exchange (DCE)

- Iron Ore Futures

- Palm Olein Futures – since 22 Dec 2020

- DCE Palm Olein Options – since 18 Jun 2021

- No1. Soybean – since 26 Dec 2022

- No1. Soybean Options – since 26 Dec 2022

- No2. Soybean – since 26 Dec 2022

- No2. Soybean Options – since 26 Dec 2022

- Soybean Meal – since 26 Dec 2022

- Soybean Meal Options – since 26 Dec 2022

- Soybean Oil – since 26 Dec 2022

- Soybean Oil Options – since 26 Dec 2022

-

Zhengzhou Commodity Exchange (ZCE)

- Purified terephthalic acid (PTA) Futures

- NEW: Rapeseed Oil – since 12 Jan 2023

- NEW: Rapeseed Oil Options – since 12 Jan 2023

- NEW: Rapeseed Meal – since 12 Jan 2023

- NEW: Rapeseed Meal Options – since 12 Jan 2023

- NEW: Peanut Kernels – since 12 Jan 2023

- NEW: Peanut Kernels Option – since 12 Jan 2023

For more updates regarding Orient Futures Singapore and the Chinese Derivatives Market, please refer to Orient Futures Singapore’s Website Blog.

东证期货国际(新加坡)简介

我们是 上海东证期货有限公司的直属全资子公司, 也是东方证券股份有限公司的间接控股子公司。

作为持有新加坡金融管理局(MAS)颁发的《资本市场服务许可证》的机构, 我们也是新交所、 亚太交易所和, 洲际(新加坡)交易所的会员。 自2023年8月,企业客户可通过东证期货新加坡 进入巴西交易所, 享无限机遇。

我司提供 全方位资本市场服务,涵盖证券、 场内衍生品、 及杠杆外汇等多类产品。