The Chinese property market holds significant sway over the country’s economy, impacting various sectors, including the metal industry. This article explores the relationship between property prices in China and metal prices, delving into the current state of the property market, the effects on the metal industry, and the performance of the different metals affected so far this year.

China Property Market

The Chinese property market has experienced remarkable growth over the years, driven by urbanization, rising incomes, and favorable government policies. However, due to the pandemic restrictions, China property market has been on a decline since the second half of 2021. Bloomberg reported that there was a 290 billion decline in income from land sales last year in China, and that drop continued into the first two months of 2023.

Although the China housing market have showed signs of recovery earlier this year, it is still struggling to turn around. CNBC reported that Chinese real estate sales fell to 900 billion yuan ($126.87 billion), below last year’s monthly average of 1.1 trillion yuan.

However, the pace of declines might be eased thanks to state support measures and the lifting of the government’s strict anti-Covid policies. Economists and analysts believe policymakers will continue to roll out more support measures to stimulate home demand this year, as part of Beijing’s overall goal to bolster the US$17-trillion economy after a sharp Covid-induced downturn in 2022.

China Real Estate & Metal Industry

The link between the Chinese housing market and the metal industries are primarily established through construction activity. When property sales thrive, construction projects increase, boosting the demand for metals. This surge in demand exerts upward pressure on metal prices. Conversely, a slowdown in property sales can lead to reduced construction activity, dampening the demand for metals and causing prices to decline. Additionally, property market regulations and speculative investment can create volatility in metal prices.

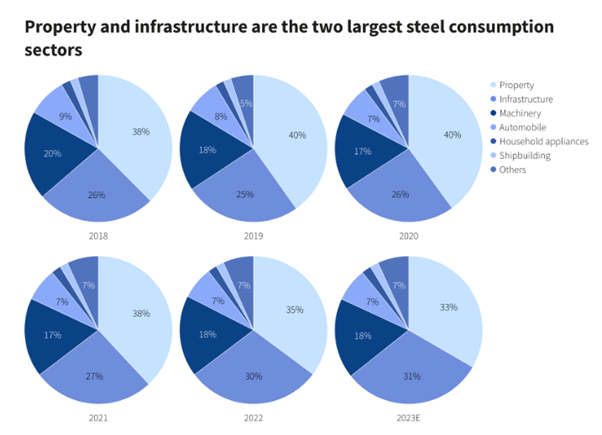

Figure 1: Reuters.com on the consumption of steel in the different sectors across the years.

China property market is one of the largest consumer for metals per year, consuming up to 286 million metric tons of just reinforcement steel bars per year. The decline in the Chinese real estate means that less demand for metals are needed, which in turns affects the prices of the various metals used for construction of houses, primarily steel.

The graphic above by Reuters shows that steel demands in China in China property market has been on a decline since 2021. In April this year, steel demands declined by 3.4% and 2.5% in May respectively.

Metal Prices and Outlook

Steel

Due to the decline in demands of steel, Steel prices had seen a steep drop since May 2022. The global market weakened in late March 2022 amid spiralling inflation, Covid-19 lockdowns in parts of China and the conflict between Russia and Ukraine heightened demand outlook uncertainty in 2022 and 2023.

According to Trading Economics, Steel rebar futures prices in China have hit their lowest in three years on May 25th this year, hitting the price of CNY 2,460 per tonne. This highlights the decline in the world’s second-largest economy, especially in its struggling property sector.

However, the Steel rebar futures have since rebounded to CNY 3,600 per tonne.

According to Trading Economics’ global macro models and analysts, they expect Steel to trade at 3526.91 Yuan/MT by the end of this quarter, and at 3347.10 Yuan/MT in 12 months’ time.

Copper

Reuters reports that the slowdown in the Chinese housing market could have a broader impact beyond just steel prices. The decrease in steel consumption could also serve as a warning sign for copper, an industrial metal that typically responds to the construction cycle with a delay.

Trading Economics reports that Copper prices have fallen more than 16% since its January high this year. Copper futures have approached the $3.7 per pound mark, rebounding from the six-month low of $3.5 touched on May 24th.

In May 2023, copper inventories at the Shanghai Futures Exchange dropped to less than 135 thousand tonnes, marking the lowest level so far this year. Similarly, inventories at the London Metal Exchange reached less than 60 thousand tonnes, the lowest since 2005. Additionally, Chile has announced that this year’s copper output is expected to decline by as much as 7%, following a 10.6% drop in 2022. Meanwhile, there is increased speculation about incoming stimulus measures from the Chinese government due to positive manufacturing activity and industrial growth figures in China.

Copper is expected to trade at 3.64 USD/LB by the end of this quarter, and at 3.41 USD/LB in 12 months’ time.

Orient Futures Singapore offers Copper Grade A Futures trading under the London Metal Exchange (LME) and Bonded Copper Futures under the Shanghai International Energy Exchange.

东证期货国际(新加坡)简介

我们是 上海东证期货有限公司的直属全资子公司, 也是东方证券股份有限公司的间接控股子公司。

作为持有新加坡金融管理局(MAS)颁发的《资本市场服务许可证》的机构, 我们也是新交所、 亚太交易所和, 洲际(新加坡)交易所的会员。

我司提供 premium customer service at an affordable cost to all our clients. Our team will 场内衍生品、 及杠杆外汇等多类产品。