INE Launch New Containerized Freight Index Futures Contracts

On 18th August 2023, the Shanghai International Energy Exchange (INE) made a significant announcement regarding the launch of the new Containerized Freight Index Futures Contracts.

International traders can now trade the new Containerized Freight Index Futures Contracts through an overseas intermediary such as Orient Futures Singapore. They can do so through the QFI China Scheme or China’s Internationalized products.

This article seeks to provide a recap of the performance of the new Containerized Freight Index Futures in 2023 and explore the outlook of it in the coming year.

INE Shanghai Containerized Freight Index Futures

The SCFIS is an index for sea freight rates for imports from China worldwide. It is an indicator of freight prices for container transport from Chinese ports. These ocean freight futures usually settle over the average of the spot price during the corresponding month.

With the mechanism of the futures in place, the industry will allow more hedging and risk management by traders, and this is expected to open new models of trade.

Click to find out about INE Containerized Freight Index Futures Contract and Shanghai International Energy Exchange trading hours.

INE Shanghai Containerized Freight Index Futures 2023 Performance

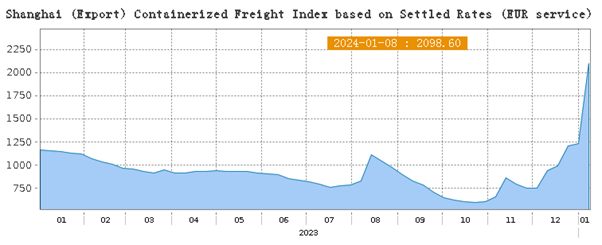

According to data from Shanghai Shipping Exchange (SSE), INE SCFIS price have been on a slow decline, with it peaking in August 2023.

Baidu reported that since December, several container ships have been hit by Houthi armed forces in the Red Sea area. Container shipping companies have announced the suspension of Red Sea routes, opting for routes around the Cape of Good Hope to Europe.

Although some Red Sea routes have partially resumed, the situation remains uncertain.

The Red Sea is a crucial channel for the Asia-to-Europe route, with about 30% of Jiyun routes entering Europe via Asia-Red Sea-Suez Canal. The global logistics supply chain is once again facing disruption, leading to a significant surge in European freight rates.

INE Shanghai Containerized Freight Index Market News

Baidu reported that the Shipping Index (European Line) futures contracts collectively hit the limit on 2nd January this year, with the main contract EC2404 rising by 20%, closing at 1924.8 points.

Chen Zhen, Director of Shipping and Commodity Index at Fangzheng Zhongqi Futures, believes there are two main reasons for this – first, the latest SCFI (Shanghai to Europe) weekly comparison surged by 80%, reaching a new high since October 2022, and second, during the New Year holiday, Maersk vessels in the Red Sea were attacked again, leading to the announcement of a suspension of Red Sea voyages within 48 hours.

He added that the year-end surge is mainly due to geopolitical tensions and shipping companies raising prices. In fact, the fundamentals have not improved and are even deteriorating.

In 2024, there is significant pressure on new ship launches globally, and the European economic recovery is weak. According to Drewry’s data, effective capacity may decrease by 9% in 2024 due to the suspension of the Suez Canal, but this still cannot alleviate the supply-demand imbalance.

On 1st January 2024, Maersk announced the resumption of voyages in the Red Sea, with 21 vessels on the Asia-Europe route.

INE Shanghai Containerized Freight Index 2024 Outlook

According to Baidu, the Shanghai Containerized Freight Index (SCFI) for Shanghai to Europe/Shanghai to the Mediterranean routes has increased by 80%/70% on a weekly basis since January.

The institution predicts that, influenced by this event, European/Mediterranean route prices in January are expected to further rise on a month-on-month basis.

The impact on the oil and bulk cargo market is limited due to the seasonal downturn. It is recommended to closely monitor the impact of the development of the situation on global supply chain disruptions. If the disruption persists for an extended period, it will gradually transmit to other Jiyun routes and oil/bulk cargo prices.

Huafu Securities stated that the uncertainty of the Red Sea route has not significantly improved in the short term due to the presence of the escort fleet.

Bypassing the Cape of Good Hope is likely to remain the mainstream choice for major shipowners, providing support to Jiyun freight rates. Subsequent attention should be paid to changes in the situation.

东证期货国际(新加坡)简介

我们是 上海东证期货有限公司的直属全资子公司, 也是东方证券股份有限公司的间接控股子公司。

作为持有新加坡金融管理局(MAS)颁发的《资本市场服务许可证》的机构, 我们也是新交所、 亚太交易所和, 洲际(新加坡)交易所的会员。

我司提供 premium customer service at an affordable cost to all our clients. Our team will 场内衍生品、 及杠杆外汇等多类产品。