China Futures: INE Low Sulphur Fuel Oil (LSFO) Futures

Did you know that 90% of global trade is fullfilled via sea logistics? This makes Marine fuel a key component affecting world trade. The Maritime industry used to rely on high sulphur fuel oil, but since 2020, the International Maritime Organization (IMO) 2020 policy, had been a game changer in the type of fuel used. Read more:

What is Low Sulphur Fuel Oil (LSFO)?

- LSFO is a type of refined oil principally used in oil refining and chemical, transport, construction, metallurgy industries and Marine fuel. By sulfur content, marine fuel can be classified into grades I, II, and III; corresponding to a maximum sulfur content of 3.50%, 0.50%, and 0.10% m/m, respectively.

- Important as a Marine fuel (which fuels 90% of global trade).

- Since 2020, LSFO has become a mainstream product for Marine fuel; since the International Maritime Organization (IMO) requires a sulfur cap of 0.50% m/m on fuel oil used by ships worldwide (IMO2020). If you are interested to read more about the IMO 2020 policy, click here.

LSFO Demand and Supply

- Global annual production is about 500 million metric tons.

- Global consumption recent years reached 280 million metric tons; with Asia-Pacific region accounting for 45% of the global total.

- Fluctuation of international crude oil price depends largely on factors such as demand by shipping market, Supply and demand of the Singapore market, Exchange rate, environmental policies, political situations. Before there is an active and effective benchmark price for low sulfur fuel oil, the price for 10 ppm diesel will be used as the benchmark.

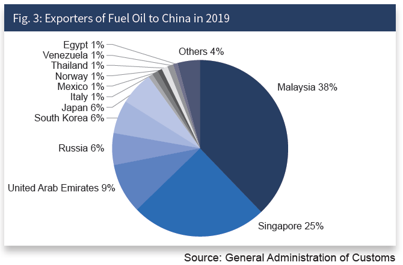

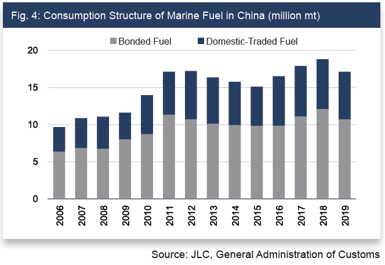

Marine Fuel oil is one of the most market-driven petroleum and petroleum products in China. China’s marine fuel market can be divided into the domestic-voyage segment and the bonded fuel segment. Supply for the former segment mainly comes from domestic refineries and blending companies, while that for the latter comes almost exclusively from import.

Potential of the INE (Shanghai International Energy Exchange) LSFO Futures Contract:

- This contract features marine fuel meeting stricter international emissions rules and the second oil contract after Shanghai crude – open to foreign investment.

- With few competitors, the contract potentially can grow into an Asian benchmark for shipping fuel, especially as Chinese refineries are equipped to produce the low-sulfur fuel.

- This contract provides the market a more effective tool to hedge risks as the global shipping industry transforms from high to low-sulphur fuel.

Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

To learn how to participate in the INE LSFO Futures: Click here

For Contract Specifications of the INE LSFO: Click here

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange) which means our clients get direct access to the China markets. Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

Sources and PC:

- Shanghai International Energy Exchange

- INE Low Sulphur Fuel Oil Futures Handbook for Trading 2020