China Futures: INE Copper Futures

Did you know, for the past 10,000 years, the world’s most mined commodity, behind aluminum and iron is Copper?

Did you know that China’s INE (Shanghai International Energy Exchange) just opened up Copper Futures Contract for International trading last week?

What is Copper?

- Copper is a non-ferrous metal widely used in the production of cables and wires worldwide and is an important component of electrical cabling in construction.

- Copper cathode is the primary raw material input of copper rod for wire and cables for construction.

Copper Futures Demand and Supply

- Though the industry has been impacted by the COVID-19 pandemic, for 2021, the IWCC expects output to increase to 24.3 million tonnes, and a demand increase by 4.4% to 23.6 million tonnes.

- Half of the world’s copper demand comes from China and is expected to increase to 12.2 million tonnes by 2021.

Copper Benchmarks

The international copper pricing benchmark are the London Metal Exchange (LME) contract, and the CME Group’s copper contract in the US.

The Shanghai Futures Exchange (ShFE) has a domestic copper contract, but it is not accessible to foreign market participants.

The new INE copper contract (quoted in yuan) has long been awaited by foreign investors looking to hedge exposure in China.

Potential of the INE (Shanghai International Energy Exchange) Copper Futures Contract:

The economic disruption due to the pandemic has resulted in greater uncertainty in supply and demand for copper.

Copper futures can be used as a hedging tool for price mitigation.

Copper futures also offer advantages like central clearing and transparency of price among traders.

If you wish to hedge your exposure in China through Futures contracts through the INE Copper Futures Contract, contact us.

Orient Futures Singapore is an Overseas Intermediary of INE (Shanghai International Energy Exchange) which means our clients get direct access to the China markets. Partner with Orient Futures Singapore and let us help you navigate into China’s Capital Markets.

The INE Copper Futures Contract is the latest contract China opened up for International participation. Certainly, that would be more coming as China continues to open up its markets to foreign investments.

Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

To learn how to participate in the INE Copper Futures: Click here

For Contract Specifications and trading manual of the INE Copper Futures: Click here

Do not miss out on the opportunities in the liberalisation of China’s Capital Markets. Contact us today.

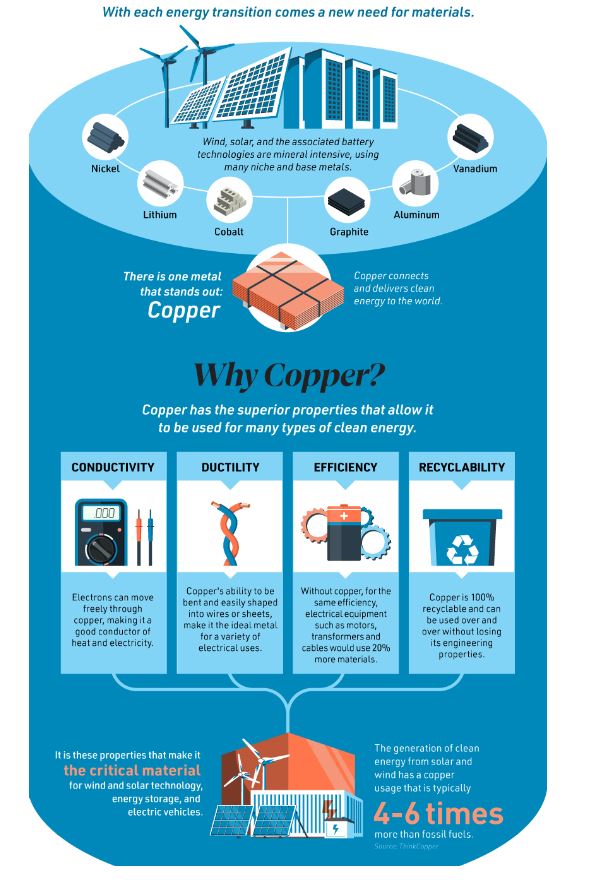

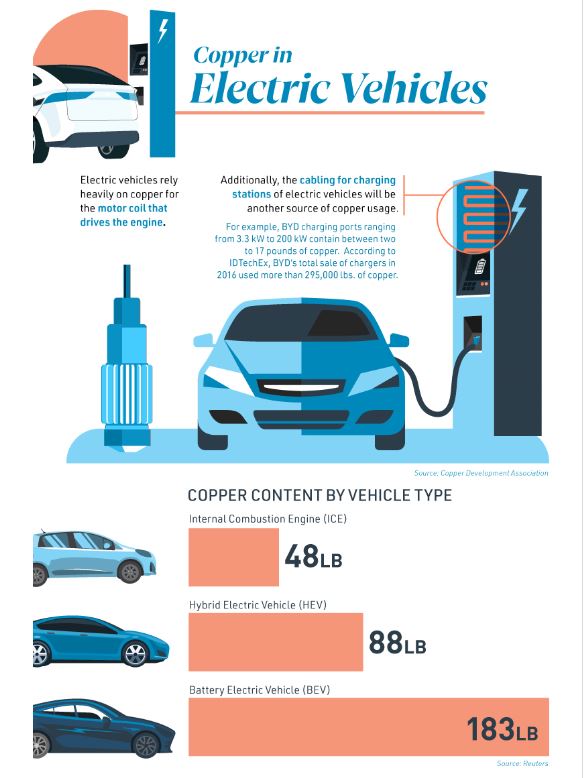

Some interesting facts of Copper according to infographics presented by the Copper Development Association Inc., via Visual Capitalist.

The full infographics is presented by the Copper Development Association Inc., via Visual Capitalist here.

Sources

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/global-copper-market-in-supply-glut-in-2020-2021-8211-iwcc-58811137

http://www.ine.cn/en/products/bc/manual/manual/

https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy

Picture Credit :Courtesy of Visual Capitalist