Methanol is a chemical building block for everyday products such as plastics, paints, pesticides, and construction materials.

It is also used as a feedstock for biodiesel production. Given its use as a base material and energy production source, the demand for methanol can be said to be growing worldwide. Some of the most famous production plants include the Japanese Mitsubishi Gas Chemical company, which is the first company in Japan to successfully synthesize natural gas into methanol.

Elsewhere in another part of the world, another large producer of Methanol is Methanex, which also has a branch in China. Therefore, this article will cover more about methanol futures as one of the new products offered by ZCE under the QFI scheme.

About Methanol Futures

Methanol is considered a cleaner and more sustainable form of fuel in comparison to petrochemicals; hence, more companies are turning to methanol to align with the ethos of ESG and environmental footprint movements.

The usage of methanol as the fuel of the future has also been studied and results show that methanol allows for improved efficiency, better tolerance of vapor pressure, and better resistance to oxidation in the atmosphere. All these factors contribute to the environmentally and economically sustainable future that is envisioned by global targets as of date.

Methanol Futures contracts and the capital markets play a supporting role in this by helping producers, traders, and downstream users manage risks. Apart from ZCE Methanol Futures, SGX had also launched methanol futures and swap contracts in early 2020, in which, records of growing demand dated 2019 had already achieved 17% year-on-year to 29.3 million metric tonnes.

Methanol Futures Contract

With the most recent launch being the ZCE QFII approved Methanol Futures Contract, the following are the specifications:

The contract for Methanol Futures is traded at 10 metric tons/ lot, with a minimum price fluctuation of CY1/metric ton.

Trading Hours are from Monday to Friday, at these trading hours:

Trading Day

9:00 a.m. – 11.30 a.m (T-session, Beijing time)

1:30 pm – 3:00 p.m (T-session, Beijing time)

Benefits Of Trading With Zhengzhou Commodity Exchange

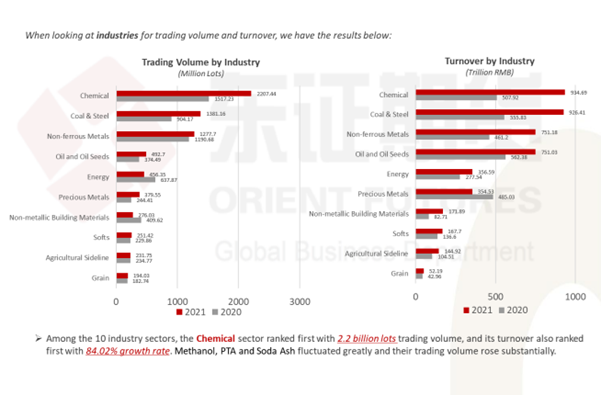

In 2021, China futures market registered a trading volume of 7.514 billion lots and a turnover of 581,199 trillion RMB, up 22.13% and 32.84% year-on-year (YoY) respectively. Among the five exchanges, ZCE registered the highest trading volume (34.36%) while SHFE registered the highest turnover. (33.23%).

Apart from the high trade volume, based on research by our parent company, Orient Futures, it is recorded that Methanol is one of the products that had the most increase in trading volume.

Therefore, the first benefit of trading with ZCE is the ability to participate in the large trading market and initiate price discovery mechanisms.

Apart from a large trading volume and positive trend, trading with ZCE is also beneficial as it allows traders to use cross-arbitrage strategies for hedging purposes or other types of trade strategy. Learn more about cross-arbitrage strategies for the QFI scheme here.

As an overseas intermediary of Chinese futures exchanges, Orient Futures Singapore offers direct clearing, access, and settlement. The company also specializes in providing premium services for institutional clients that are trading other products or the application for QFII qualifications.

Market News

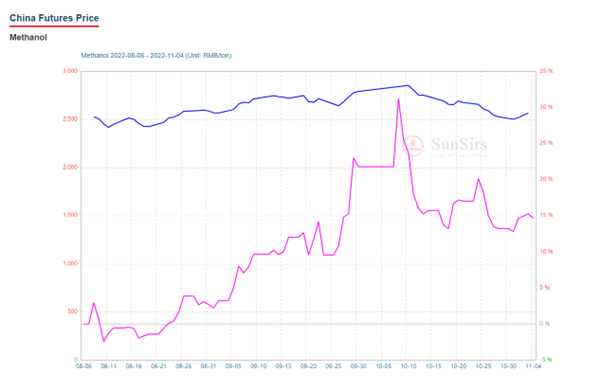

To aid traders in collecting market data from the methanol market, the following is the China futures spot price can provided by Sunsirs , attached below is the graph as of 4/11/2022.

Additionally, based on the market report from ZCE on 14/10/2022, in October, the Methanol price oscillated up. The dominant contract MA 2301 fluctuated within 296 Yuan/ton between 2,536 and 2,832 Yuan/ton and closed at 243 Yuan/ton or 9.44% at 2817 Yuan/ton from the price of the last month’s end.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.