Soybean Futures

Soybeans, originating in Asia thousands of years ago, have evolved into one of the most versatile and widely used crops globally. Their applications span various industries, from Asian cuisine’s soy sauce and tofu to soybean oil, a common cooking oil. Notably, soybeans play a crucial role in animal feed, serving as a primary protein source for livestock production worldwide.

Given its high demand and broad applications, Soybean futures are actively traded on global commodity exchanges. The Dalian Commodity Exchange (DCE) and the Chicago Board of Trade (CBOT) are two major exchanges providing soybean futures contracts. These contracts are essential for market participants engaging in hedging and speculative activities.

As we usher in the new year of 2024, this article aims to recap the performance of Soybean Futures in 2023 and explore what lies ahead for Soybean Futures in 2024.

Trading Soybean Futures and Options

Traders can trade soybean futures and options from both the Dalian Commodity Exchange (DCE China) and Chicago Board of Trade (CBOT) through Orient Futures International Singapore. To trade Dalian Soybean Futures contracts (Soybean No.1 and 2), International traders would require an overseas intermediary like Orient Futures Singapore, through either the QFI China Scheme or the Internationalized products.

DCE Soybean Futures Contract Specification

The Dalian Commodity Exchange Soybean Futures Contract has the following specifications:

The DCE Soybean Futures Contract has a minimum price fluctuation of CNY 1/metric ton.

Contract months are January, March, May, July, September, and November.

The last trading day of the contract month is the 10th trading day of the delivery month.

Dalian Commodity Exchange trading hours are from Monday to Friday, at these trading hours:

9:00AM – 11:30AM and 1:30PM – 3:00PM Beijing Time

DCE Soybean Futures Ticker Symbol: A

CBOT Soybean Futures Contract Specification

The CBOT Soybean Futures Contract has the following specifications:

The CBOT Soybean Futures Contract has a minimum price fluctuation of ¼ of one cent (0.0025) per bushel which is = $12.50.

Contract months are for 15 monthly contracts of Jan, Mar, May, Aug, Sep and 8 monthly contracts of Jul and Nov listed annually after the termination of trading in the November contract of the current year.

The last delivery date of the good is on the second business day following the last trading day of the delivery month.

CBOT trading hours are from Monday to Friday, at these trading hours:

8:30 am – 1:20 pm CT

Or Sunday to Friday:

7:00 pm – 7:45 am CT

CME Globex Soybean Futures Ticker Symbol: ZS

Click to find out more on DCE trading hours, CBOT trading hours and also DCE and CBOT Soybean Contract Specifications.

Apart from Soybean Futures, both CBOT and DCE also offer other commodity futures such as Iron Ore Futures, Rough Rice Futures, and more.

Soybean Futures 2023 Performance Recap

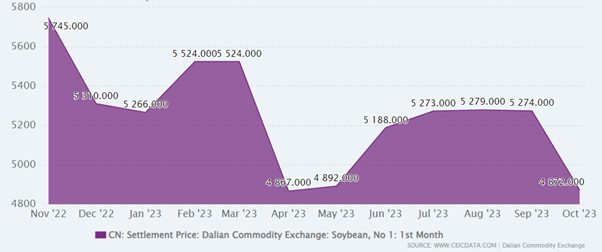

According to the data by Ceidata, prices for DCE Soybean No. 1 Futures has been on a decline in 2023, starting at 5,266 RMB/Ton in January 2023 to 4,832 RMB/Ton, as of 21st Dec 2023.

Trading Economics also reported that CBOT Soybeans Futures decreased 14.42% since the beginning of 2023, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity.

According to Investing.com, the decline in soybean prices can be attributed to several fundamental factors. A key factor is the record domestic stock of edible oil, creating a surplus in the market. This abundance of edible oil has led to reduced demand for soybeans, impacting the crush margin negatively.

Furthermore, increased soybean production has contributed to a higher overall supply, intensifying the downward pressure on prices. These combined factors highlight the intricate balance between supply, demand, and market dynamics influencing soybean prices.

Soybean Futures Market News

This latest soybean market news is based on Orient Research Weekly Report on Agricultural Products dated 17 December 2023 and other sited sources.

Soybean Supply and Demand

There have been little changes in the supply and demand situation of Soybeans in China, with sufficient supply of new grains.

Despite some impact on logistics due to rain and snow, prices did not adjust significantly due to weak downstream demand. The State Reserve did not hold a domestic soybean auction for the week of 11th December 2023, and grain depot purchases have basically concluded, with no policy support to boost the market.

Traders’ sentiment for the future continued to deteriorate, with a Steelhome survey showing the proportion of traders bearish on the future market increasing from 45% to 50%, while 47% expected consolidation, and only 3% were optimistic. The domestic oversupply situation is difficult to change, and soybean futures are expected to continue a weak trend.

Soybean Futures Price

According to Barchart, DCE Soybean No. 1 Futures is priced at 4,832 RMB/Ton, as of 21st Dec 2023. Click to find out the latest price on DCE Soybean Futures.

Soybean Futures 2024 Market Outlook

According to Trading Economics, Soybeans is expected to trade at 1288.27 USd/BU by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Looking forward, we estimate it to trade at 1220.32 in 12 months’ time.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.