About London Metal Exchange Aluminum Futures

London Metal Exchange (LME) is one of the world’s largest commodities exchanges in metals. Established in 1877, LME have many futures and options contracts. This includes gold, silver, zinc, copper and also aluminum.

Launched in 1978, LME’s Primary High Grade Aluminum Futures have emerged as a leading benchmark for the global aluminum market. The futures contract for aluminum is designed to provide market participants with a reliable LME aluminum price discovery mechanism, risk management, and investment opportunities.

Over the years, aluminum LME Futures contracts have gained significant traction and demonstrated remarkable performance over the years. This article aims to look at 5 things to know about LME Aluminum Futures.

1. Uses of Aluminum

Aluminum is used in a wide range of products, including cans, foils, kitchen utensils, window frames, beer kegs, automobile, and aeroplane parts.

This is largely due to its unique properties. Aluminum possesses low density, non-toxicity, high thermal conductivity, exceptional corrosion resistance, and is easily cast, machined, and formed. Additionally, it is non-magnetic and non-sparking, ranking as the second most malleable metal and the sixth most ductile.

The unique aluminum properties make it high in demand as it is used in many industries and sectors such as construction, automotive, aerospace, packaging, and electrical appliances, among others. This stimulates market growth in aluminum.

2. LME Aluminum Futures Contract Specifications

LME Primary High Grade Aluminum Futures Contract has the following specifications:

LME currently offers a contract size of 25 tonnes/lot, while the delivery dates vary for the daily, weekly, and monthly futures.

The last trading day of the contract month is up until the close of the first Ring the day before the prompt date.

Trading Hours are from Monday to Friday, at these trading hours:

1:00 am – 7:00 pm (British Summer Time, GMT + 01:00)

Primary High Grade Aluminum Futures symbol: AH

Orient Futures Singapore provides brokerage services for this futures contract, refer to the specifications here.

3. Global Aluminum Market Supply and Demand

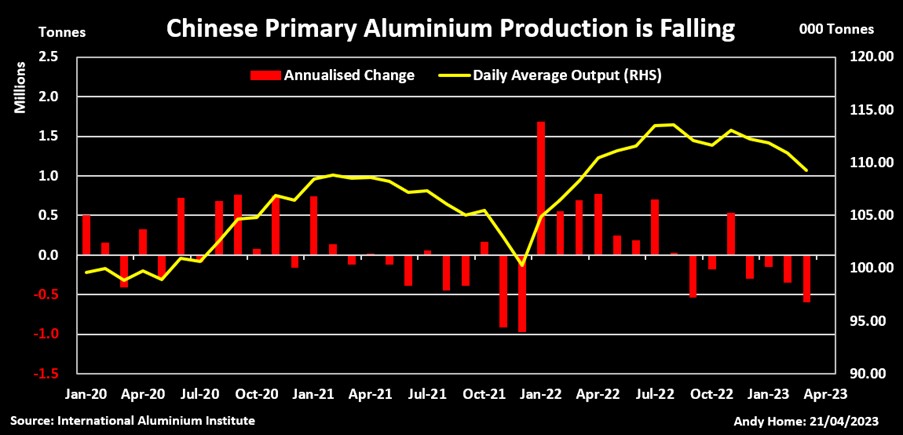

Figure 1. Chinese Aluminum Production Chart from Retuers.com

According to reports from Reuters, aluminum supply has been on a decline recently. And this is largely due to 2 main factors.

Lack of Rainfall

The amount of aluminum produced globally grew by 2.0% year-on-year to 16.9 million tonnes of aluminum in the first three months of 2023. However, China’s output of aluminum in March 2023 reached a one-year low, totalling 39.9 million tonnes. This marked a decline of 1.6 million tonnes compared to the record set in August 2022 at 41.5 million tonnes.

Of all the aluminum producing countries, China is responsible for nearly 60% of the world’s primary metal production. They saw a 3.9% increase in output compared to the first quarter of 2022, but the growth rate sharply slowed to just 0.9% in March.

Within this 60%, Yunnan province contributes approximately 12% of China’s aluminum supply, producing 4.2 million tonnes in 2022.

In efforts to promote eco-friendliness, Chinese operators have shifted from coal-powered provinces to produce low-carbon “green” aluminum using hydro energy. However, the hydro power generation relies on sufficient rainfall, and Yunnan is currently facing its worst drought in decades.

According to Reuters, the provincial capital Kunming has received only 10% of its normal precipitation so far this year. This prompted an orange drought alert, the second most severe warning in a four-tiered system.

Consequently, China’s aluminum production has become highly dependent on weather patterns in the southern region, which in turn affects the global aluminum market.

Production Slump

Western European aluminum production level has been experiencing a downward trend since 2017. However, the invasion of Ukraine by Russia and the subsequent surge in energy prices have further accelerated this decline.

According to Reuters, output in the region dropped by 12.5% last year and has continued to slip in 2023. The average annualised production for the first four months of this year stood at 2.7 million tonnes. In comparison, West European run-rates exceeded 4.5 million tonnes fifteen years ago.

In the United States, metal production has also been on a decline since 2019. The United States Geological Survey (USGS) reported that two out of seven domestic smelters are fully curtailed, and three are operating at reduced capacity. By the end of last year, domestic production was estimated to be running at only 52% of capacity, with import dependency increasing from 41% in 2021 to 54%.

Both Western Europe and the United States are grappling with challenges in their aluminum production, contributing to a complex global supply landscape for the metal.

4. LME Aluminum Prices

Since 2020, Aluminum future price have experienced a volatile and dynamic performance. The global pandemic and geopolitical tensions presented significant challenges to the aluminum market, leading to fluctuations in supply and demand dynamics.

At the beginning of 2020, the aluminum futures market experienced a sharp decline in prices as industrial activities slowed down and global trade was disrupted due to the pandemic. However, as economic activities gradually resumed and stimulus measures were implemented, the aluminum market began to show signs of recovery.

In 2021, aluminum price exhibited a strong rebound as economies reopened after Covid-19 lockdowns. Throughout the year, developments in China, which accounted for half of global aluminum production in 2020, played a dominant role in influencing the price action of this industrial metal.

By October 2021, aluminum price reached 13-year highs before experiencing a drop of approximately 40% below record levels in late November 2022. This is due to a weak demand outlook for the metal.

As of June 12, 2023, LME aluminum futures have been trading within the range of 2,200 to 2,300 USD per metric ton, according to Trading Economics.

5. Outlook on LME Aluminum Futures

According to Shanghai Metals Market (SMM), there is a prediction of increased volatility in aluminum futures prices, indicating that the price shows no signs of stabilising. However, there are several factors that would contribute to a higher demand for aluminum such as it being lightweight and recyclable.

The infrastructure bill of $1.2 trillion introduced by US President Joe Biden, which was passed in late 2022, has allocated $550 billion for the funding of bridges, roads, and energy systems over the next five years.

This has generated optimism in the industry as there would be significant investments in public transit, electric vehicles, and charging infrastructure included in the bill.

This increases the reliance on aluminum in these infrastructure projects as it helps to reduce vehicle weight, improve efficiency, and enable innovative design solutions.

Fitch Solution’s aluminum price forecast for 2025 projects the metal to trade at $3,000 per tonne, indicating a positive outlook for aluminum prices. Looking further ahead, Fitch’s forecast for 2030 predicts the metal to trade at $3,300 per tonne, suggesting continued growth and potential opportunities in the aluminum market.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.