Fundamental trading is a method where a trader studies the overall state of the economy, the company, and the industry to determine the course of action.

As the opposite of technical trading, fundamentals place a focus on the business cycle of an economy to provide a consensus on leading or lagging factors. As a result, it is often difficult to dictate a specific list of criteria that make up a company’s fundamentals.

Nonetheless, it is possible to study the macroeconomic factors and trends, hence, this article will cover aspects of fundamentals with Palm Oil research by Orient Futures as a key example.

Example of Fundamental Trading in Futures

Fundamental analysis in futures evaluates securities by attempting to measure their intrinsic value. (Primarily through its demand and supply)

In the case of palm oil, Indonesia is the largest exporter while Malaysia is the second biggest export country of Palm Oil. These two countries are the deciding suppliers of the market.

On the other hand, China is the main importer of the country, which makes it the deciding demand of the market.

Fundamentals of Malaysian Palm Oil

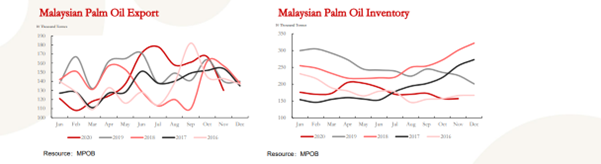

In this data set released by MPOB in 2020, the fundamentals of Malaysian Palm Oil are strong since the reduction of Palm oil production led to the low inventory.

Fundamentals of China Palm Oil

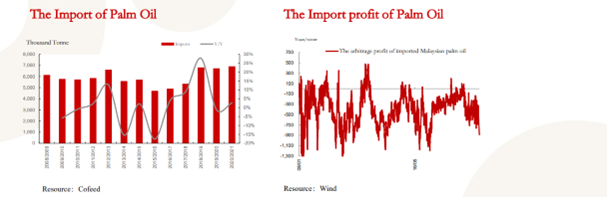

Similarly, in 2020, China imported 6.9 million tons of palm oil. After 2013, with the decline of financing imports of palm oil and the decline of domestic consumption, the consumption was close to the demand for 2011 and 2012 at an annual consumption of 5 ~ 6.82 million tons.

Moreover, driven by the stocking demand of the Spring Festival and the decrease in ship volume in the first quarter, the inventory is expected to rise in December and go down again around the Lunar New Year.

Results of Fundamental Analysis

Due to the low inventory of palm oil and the stock-preparation demand for the holiday at the end of the year, the future price of palm oil in 2011 was strongly supported. In the short term, the future price of DCE palm oil was expected to go strong because of the reduction of palm oil, while the purchase of storage would continue until the second quarter of the next year.

Taking into account the fundamentals of both shores (Malaysian and China) investors are recommended to hold the long position of DCE palm oil future contracts.

Do Fundamentals Work in Forex?

As with the example above, fundamentals can also be used in the forex market to determine the overall health of an economy. However, the factors may differ to include factors such as GDP, employment rates, interest rates, interest rates, and manufacturing, as well as their relative impact on the value of the national currency they relate to.

Interest rates are a major Forex fundamental analysis indicator. The percentage of the principle that private banks pay central banks for borrowing currencies is called a base or a nominal interest rate. Manipulating these interest rates through monetary or fiscal policies is integral to sustaining the economy over the long run. Most recently, FED rate hikes have remained a central focal point for forex investors.

The hike is in response to factors of high inflation in the USA. Apart from USA, the effects of inflation have also affected the U.K. As reported by CNBC, the inflation was “running at a 40-year high of 10.1% in September, the Bank is seen hiking its main lending rate for the eighth consecutive time.” This is also one of the biggest rate hikes in 33 years.

Therefore, when accounting for factors such as inflation in fundamentals, traders can execute defensive strategies. Alternatively, if one forecasts that there will be a pivot point toward the next year, it will also be possible to set a plan.

Are Fundamentals Important in Forex?

Fundamentals are important in forex as they provide an indicator of the market, but it is best paired with technical analysis.

Fundamentals play a major role for new retail traders or traders without a comprehensive trading background.

For example, understanding the forex economic calendar will provide a list of indicators and when they are due to be released. By keeping a tight tab on economic indicators that are focal to the market these events dictate the largest volume and price movements.

Hence, understanding fundamentals is half the battle won, and it serves as a good complement to technical indicators.

Technical Analysis

Technical analysis helps in the prediction of future market movements (that is, changes in currencies prices, volumes, and open interests) based on the information obtained from the past.

There are different kinds of charts that help as tools for technical analysis. These charts represent the price movements of currencies. Additionally, the technical indicators are obtained through mathematical processing of averaged and other characteristics of price movements.

Technical Analysis (TA) is based on the concept that a person can look at historical price movements (for example currency) and determine the current trading conditions and potential price movement.

Start Trading with Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.