As China’s derivatives market continues to flourish on the global stage, an increasing number of traders are seeking access to the Chinese market.

Traders that would like to access China’s Derivatives Market, can look to do so through Orient Futures International (Singapore) Pte Ltd (“Orient Futures Singapore”).

About Orient Futures Singapore

Orient Futures Singapore is an award-winning overseas broker for the Chinese Derivatives Market. It was awarded with the “Chinese FCM of the Year” and “Non-Bank FCM of The Year” in The Asia Capital Markets Awards 2023 by the FOW Global Investor Group.

Orient Futures Singapore is a regulated forex broker under the Monetary Authority of Singapore (MAS), and currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

Backed by one of the largest brokerage firms in China, Shanghai Orient Futures, Orient Futures Singapore is committed to offering an expansive and varied trading experience for our esteemed clients.

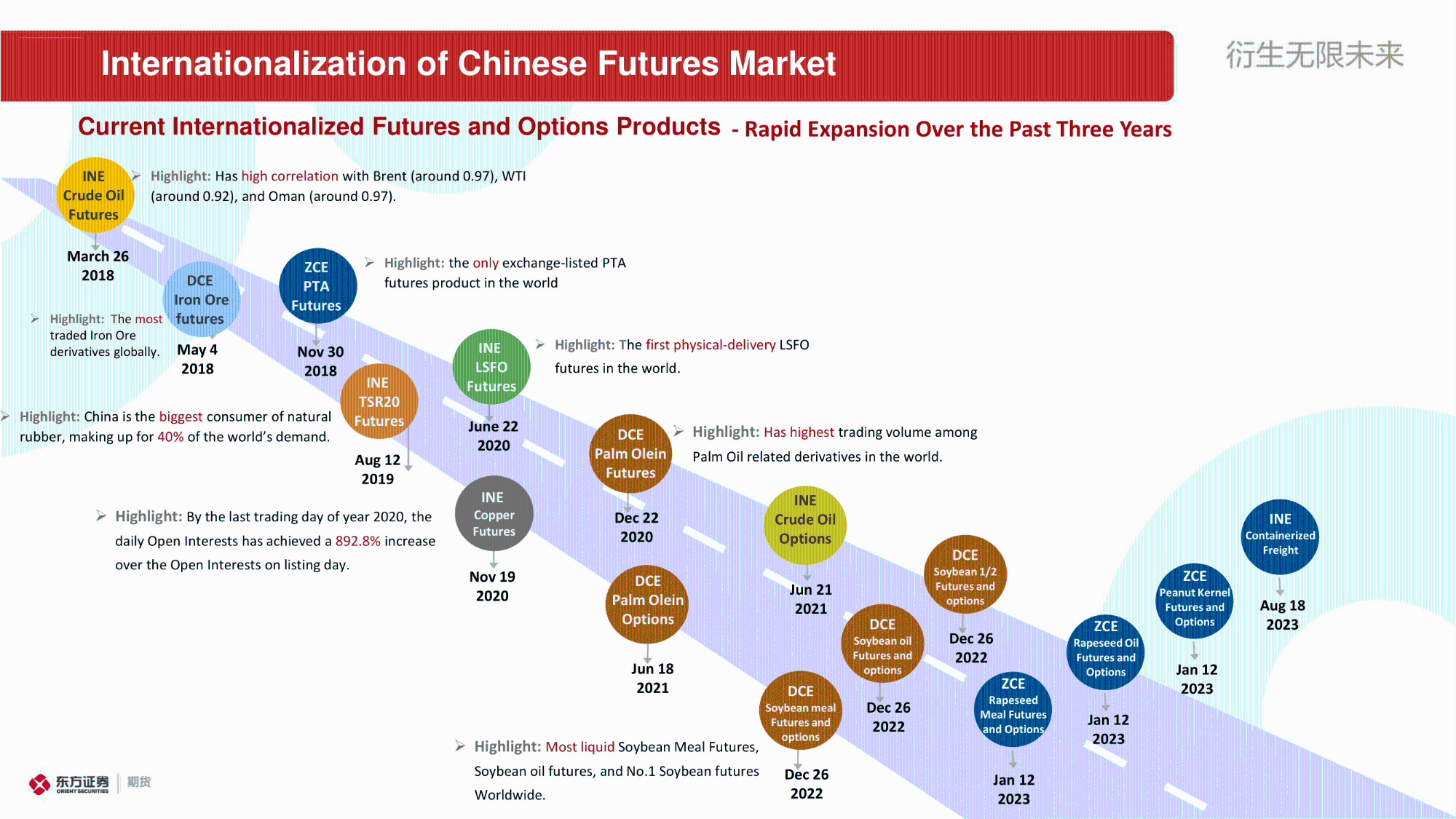

Figure 1. Internationalised Products from ZCE, DCE and INE that Traders can trade through Orient Futures Singapore

Orient Futures Singapore is an Overseas Broker for ZCE, DCE, and INE

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), Orient Futures International Singapore allows International clients to have direct access to trading, clearing, and settlement, when they participate in internationalised futures contracts in these Chinese markets through us.

Orient Futures Singapore enables International Traders to access the China Derivatives Market through either the QFI China Scheme or Internationaliszed Products.

Orient Futures Singapore offers the following products from three Chinese exchanges. These products offer good price discovery, arbitrage, and hedging opportunities.

-

Shanghai International Energy Exchange (INE)

- Crude Oil Futures

- TSR20 Rubber Futures

- Low-Sulfur Fuel Oil Futures

- Copper Futures – since 19 Nov 2020

- Crude Oil Options – since 21 Jun 2021

- NEW: Containerized Freight Index Futures – Since 18 Aug 2023

-

Dalian Commodity Exchange (DCE)

- Iron Ore Futures

- Palm Olein Futures – since 22 Dec 2020

- DCE Palm Olein Options – since 18 Jun 2021

- No1. Soybean – since 26 Dec 2022

- No1. Soybean Options – since 26 Dec 2022

- No2. Soybean – since 26 Dec 2022

- No2. Soybean Options – since 26 Dec 2022

- Soybean Meal – since 26 Dec 2022

- Soybean Meal Options – since 26 Dec 2022

- Soybean Oil – since 26 Dec 2022

- Soybean Oil Options – since 26 Dec 2022

-

Zhengzhou Commodity Exchange (ZCE)

- Purified terephthalic acid (PTA) Futures

- NEW: Rapeseed Oil – since 12 Jan 2023

- NEW: Rapeseed Oil Options – since 12 Jan 2023

- NEW: Rapeseed Meal – since 12 Jan 2023

- NEW: Rapeseed Meal Options – since 12 Jan 2023

- NEW: Peanut Kernels – since 12 Jan 2023

- NEW: Peanut Kernels Option – since 12 Jan 2023

For more updates regarding Orient Futures Singapore and the Chinese Derivatives Market, please refer to Orient Futures Singapore’s Website Blog.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.