According to Zion Market Research, the global linear low density polyethylene market size is is predicted to grow to around USD 112.21 billion by 2030. However, the Chinese LLDPE market is facing challenges that are changing its landscape in 2023.

What is Linear Low Density Polyethylene (LLDPE)?

LLDPE is most prominently used in plastic bag production. The linear low density polyethylene properties offer flexibility and durability, making it ideal for everyday packaging needs. This makes it the preferred linear low density polyethylene uses in the industry for its cost-effectiveness and eco-friendliness.

Struggles of China’s Linear Low Density Polyethylene LLDPE Market

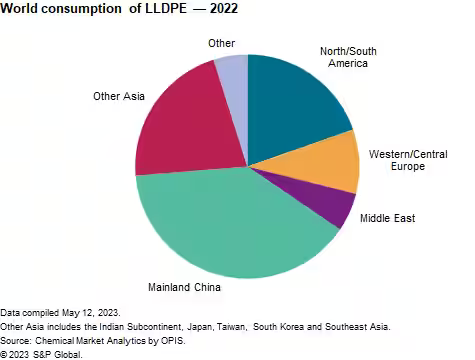

According to S&P Global, China was the world’s largest consumer of LLDPE in 2022. However, due to the weak performance of China’s economy in the first half of 2023, Independent Commodity Intelligence Services (ICIS) predicts that LLDPE demand growth in China for 2023 could decline by 2% compared to last year.

The decrease in demand can be attributed to the declining Chinese property market. Bloomberg reported a 290 billion yuan decline in income from land sales in China last year, and this decline continued into the first two months of 2023.

The fall in home and land prices is having a major impact on demand for the chemicals and polymers used in construction in China, leading to a dip in local production of LLDPE in the Chinese linear low-density polyethylene market.

QFI China and Internationalized Products

Figure 2. China’s Import of LLDP from Various Countries from ICIS

Despite the decrease in demand within China, there has been a notable increase in China’s imports of LLDPE this year, particularly from the US. ICIS reported that imports from the US to China have surged by a remarkable 220%, making it the most substantial increase in imports among China’s top ten trading partners.

Several factors contribute to this surge in imports. Firstly, the US benefits from a strong cost position, which makes its LLDPE competitive in the global market. Secondly, logistical constraints that previously limited US Polyethylene (PE) exports in 2022 have eased, facilitating increased exports to China. Lastly, the expansion of LLDPE capacity in the US has further bolstered its ability to meet China’s demand for LLDPE.

The recent implementation of stimulus measures in China to support the real estate market has created some uncertainty regarding the potential increase in domestic demand for LLDPE in China.

While the impact of these measures on domestic demand remains to be seen, S&P Global’s predictions indicate that China will maintain its position as the world’s largest producer of LLDPE in 2027. However, despite its significant production capacity, China is expected to continue importing a substantial portion of its domestic demand for LLDPE.

LLDPE Futures and Options from Dalian Commodity Exchange

Dalian Commodity Exchange offers a total of 21 futures, including internationalized futures such as Dalian Commodity Exchange Soybean Futures, iron ore futures, and more.

Dalian Commodity exchange (DCE) also offer LLDPE futures in the form of both futures and options for traders through either the QFI China Scheme or China’s Internationalized Products. International Traders would need to go through an Overseas Intermediary like Orient Futures International Singapore to trade Dalian LLDPE futures and options. Click to find out more on DCE trading hours and latest real time LLDPE Futures Prices.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.