About Copper

Copper is a highly valuable and widely used industrial metal and is used in many sectors and products. Its excellent electrical conductivity and corrosion resistance make it ideal for electrical wiring and components, plumbing systems, and construction materials.

The property market also relies heavily on copper due to its widespread use in building construction and infrastructure. It is indispensable for electrical systems, wiring and other electrical appliances.

Due to the widespread use of copper, Copper futures is also one of the most actively traded futures contracts in commodity markets.

Traders often monitor the performance of copper futures. This is due to it being an indicator of economic activity and global market sentiment. This is because copper’s widespread usage and sensitivity to economic trends make it an important barometer for overall economic health.

Trading Copper Futures

Traders can trade Copper Futures Contracts from various exchanges through Orient Futures Singapore.

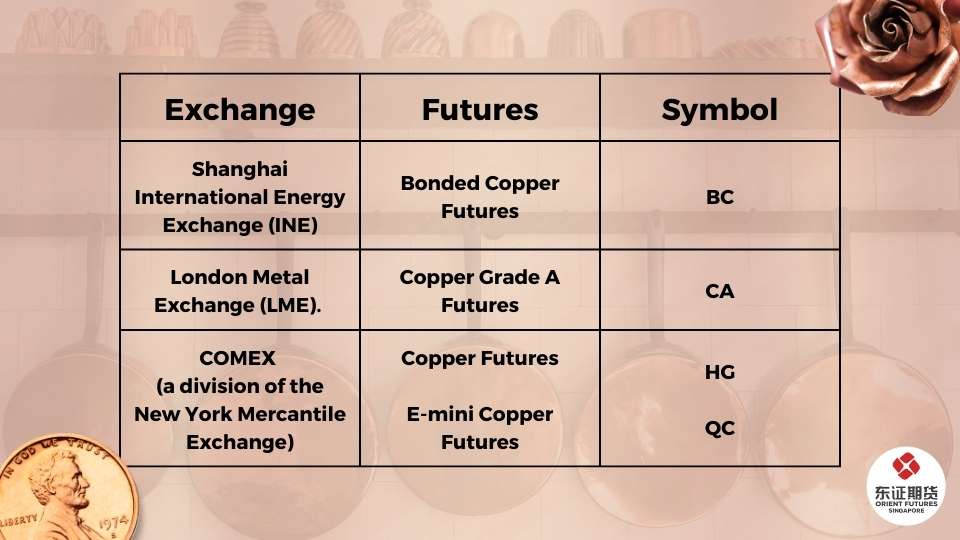

Some exchanges that traders can trade Copper futures includes Shanghai International Energy Exchange (INE Shanghai), COMEX (a division of the New York Mercantile Exchange NYMEX), and the London Metal Exchange (LME).

Here are the different Copper Futures that traders can trade under the different exchanges with Orient Futures Singapore.

Figure 1: A list of Copper Futures that traders can trade under the different exchanges with Orient Futures Singapore and the different copper futures symbols.

Each exchange offers its own specifications and trading rules for copper futures. This allows market participants to choose the platform that best suits their trading needs. Click here to find out more.

Traders can leverage the services provided by Orient Futures Singapore to access and participate in Copper Futures trading on various exchanges. By doing so, they can explore opportunities and capitalize on market movements in the copper futures market.

Refined Copper Arbitrage Trading

Traders also have the option to engage in refined copper arbitrage trading. This process involves capitalizing on price discrepancies between different markets to profit from buying and selling refined copper.

This strategy requires monitoring the prices of refined copper in various regions and identifying opportunities where copper can be purchased at a lower price in one market and sold at a higher price in another.

Through refined copper arbitrage trading, traders enhance market efficiency by contributing to liquidity, balancing regional price differences, and exploiting market inefficiencies.

Copper Futures News

Here are the latest market news and insights surrounding the copper prices based on Orient Futures’ Weekly Updates Report on the Fundamental Data of Copper Industry Chain dated 17/07/2023, as well as other relevant sources.

Supply and Demand for Copper

Global copper warehouse inventories showed a mixed trend. Inventory increased in COMEX Copper, while LME Copper inventory decreased. However, inventory in bonded areas saw a decline.

The overall global inventory increased, including both China and overseas inventory. The marginal change in inventory provided less support, weakening the pattern of internal strength and external weakness.

On the supply side, copper ore production is showing signs of recovery. However, concerns about potential supply disruptions have resurfaced, with particular attention on the Las Bambas copper mine.

According to a report by SMM, the Las Bambas copper mine in Peru was under the “Peruvian Armed Protection Period.” The set expiration date for it is by the end of June or early July.

The “Peruvian Armed Protection Period” is a designated timeframe in Peru when armed security forces are deployed to safeguard strategic installations. This includes mining operations like the Las Bambas copper mine. It aims to protect critical infrastructure, mitigate risks from protests or unrest, and ensure the smooth operation of vital industries like mining, which is crucial for Peru’s economy.

Following the expiration, there is a possibility of community road blockages and strikes resurfacing, leading to potential disruptions in production at Peruvian copper mines. These disruptions could result in increased interruptions to the mining operations.

The increase in processing fees may also impact copper production. Additionally, monitoring risks in South American mines and transport logistics in Africa is crucial.

Smelters are experiencing profitable processing, stimulating output, which is expected to accelerate in August and September.

Import losses have widened, potentially leading to a decline in net imports of refined copper. Overseas production rates remain slow, warranting observation of smelters in Europe and South America.

Limited actual demand growth is constrained by the rebound in copper price, and monitoring differences between European, American, and emerging markets is advisable.

Copper Futures Price

Here are the prices of copper futures based on 15th August 2023, based on the various exchanges.

|

Copper Futures |

Price |

|

INE Copper Futures |

54190 yuan/ton |

|

LME Copper Futures |

8291.50 USD/ton |

|

COMEX Copper Futures |

3.7055 USD/lb. |

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalized futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and Intercontinental Exchange Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.