What is Hang Seng Index?

The Hang Seng Index (HSI) is a free float, adjusted market capitalization-weighted stock market index of the largest and most liquid companies listed on the Hong Kong Stock Exchange. The index is comprised of 50 constituent stocks and is calculated and maintained by Hang Seng Indexes Company Limited.

In general, the index is used as a benchmark for the performance of the Hong Kong stock market. Like other indexes, HSI is reviewed quarterly to ensure that the constituent stocks continue to meet the index’s criteria for inclusion.

Apart from Hang Seng Index, Orient Futures Singapore also offers access to trade other indices that track different segments of the stock market including the Hang Seng China Enterprises Index (which tracks mainland Chinese companies in HK) or Hang Seng TECH index (which tracks the performance of technology companies listed in Hong Kong.

To understand more about the Hang Seng Index and its integral position in the Hong Kong economy, this article will provide details about the index and its contract specifications.

Hang Seng Index

The Hang Seng Index futures has the following specifications:

The Hang Seng Index Futures Contract has a minimum price fluctuation of one index point with a contract multiplier of HK$50 per index point.

The last trading day of the contract month is the second last trading day of the contract month.

Contract months for Short-Dated Futures, spot, are on the next three calendar month and next three-quarter months. For the Long-Dated Futures are for the three months of June and December plus the next three months of December.

Trading Hours are from Monday to Friday, at these trading hours:

9:15 am – 12:00 noon / 1:00 pm – 4:30 pm / 5:15pm – 3:00am

Hang Seng Index Futures Symbol: HSI

Hang Seng Index Standard Options Symbol: HIS

Hang Seng Index Flexible Options Symbol: XHS

The final settlement price shall be the average of (i) five-minute intervals from five minutes after the start of, and up to five minutes before the end of, the continuous trading session of SEHK; and (ii) the close of trading on SEHK on the Last Trading Day.

Types of Hang Seng Index products

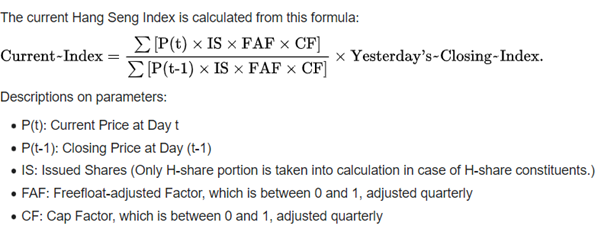

The Hang Seng Index is calculated based on the following formula:

Figure 1: Source: Wikipedia

While the Hang Seng Index is unique by providing exposure to Hong Kong’s economy, it also provides exposure to China and Asia-pacific through its specialised Hang Seng China Enterprise Index Futures. Unlike the Hang Seng Index that covers many companies that are considered blue chip companies, this index considers the H share, P chips (Bermuda, Cayman Island or Hong Kong), and the red chips (Majority owned by central and Chinese government).

Separately, for traders that are seeking exposure and lower risks, Hong Kong Exchange offers a Mini Hang-Seng Futures as well. The mini futures are one fifth the size of the HSI futures and a one hundred per cent margin offset between the Mini-HSI and HSI futures.

Figure 2:Popular Hang Seng Index Futures and Options

Apart from the Index Futures offered above, the Hong Kong Exchange also provides environmentally friendly and more recent products such as the Hang Seng Climate Change 1.5°C Target Index, Hang Seng ESG 50 Index and the HSI ESG Enhanced Select Index. The review results for these indexes are available in the newsroom here.

Trading Fees and Commission

The Hong Kong Exchange charges an exchange fee pf HK$10.00 per contract per side, and a commission levy of HK$0.54 per contract per side.

Hang Seng Index News

Quoting the Hang Seng Index’s 2022 Year-End Report, last year’s stock market were affected by factors such as elevated inflation, widening Covid Outbreak and pandemic control, in that year , the HSI declined by 15.5%. Comparatively, the Hang Seng ESG 50 performed better than the HSI.

A breakdown of the performance of the industry that constitutes the index are as follows:

Figure 3: Source: Hang Seng Year End Report 2022

On March 1st, dailyfx found that the Hang Seng roared higher as it approached the 10-days simple moving average (SMA)… support may lie at the prior lows pf 19338 and 18917. The 100-day SMA is near the latter and might lend support.

From the Hong Kong Exchange, the exchange has announced plans to open a London office in the first half of 2023. This strategic move will expand the exchange presence into the international landscape as well as to build the foundations for collaborative products between the East and the West.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.