With the escalating issue of rising temperatures and climate change, the transition to clean and renewable energy sources is no longer a choice but a necessity. Amidst the world’s scramble to reduce greenhouse gases (GHG), an unassuming chemical compound has emerged as a linchpin in this quest: Lithium Carbonate.

With its pivotal role in the development of lithium-ion batteries, powering everything from electric vehicles (EVs) to grid-scale energy storage, it raises a crucial question: Can lithium carbonate truly be the solution to our clean energy aspirations? In this article, we embark on a journey to delve into the multifaceted world of lithium carbonate to answer that question.

What is Lithium Carbonate?

Lithium carbonate is a chemical compound composed of lithium, carbon, and oxygen, often used in the production of lithium-ion batteries crucial for various electronic devices and electric vehicles.

Importance of Lithium Carbonate in the Transition to a Carbon-Free World

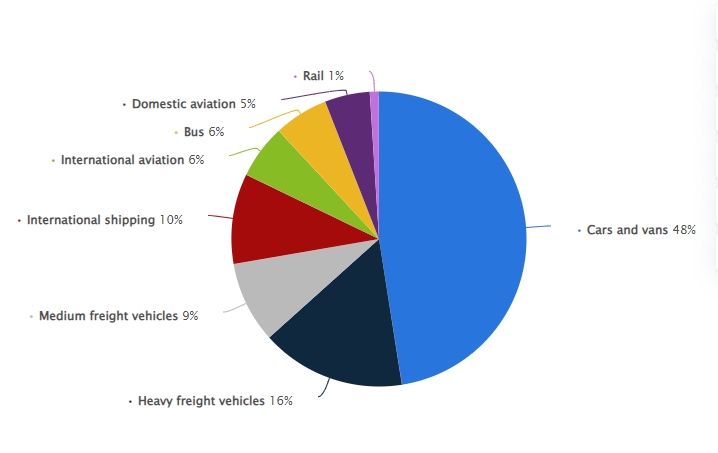

According to Statista, carbon emissions produced by cars account for approximately 3.2 million metric tons. This is roughly one-fifth of the total global carbon dioxide CO2 emissions, as reported by Our World in Data.

While nearly half of the total carbon emissions come from cars and vans, Lithium Carbonate may be the solution.

Rise of Electric Vehicles (EVs) in Automobile Industry

In recent years, the prevalence of EVs has been on the rise. According to Canalys, global EV sales grew by 49% to reach 6.2 million units in the first half of 2023. This accounts for 16% of the global light vehicle market, marking a substantial increase of 12.4% from the first half of 2022.

Lithium Carbonate and EVs

Lithium carbonate plays a pivotal role in the fight against climate change as a key component in the production of lithium-ion batteries. These batteries power a wide range of devices, including smartphones and laptops, but most importantly, they drive electric vehicles (EVs).

The use of lithium-ion batteries has the potential to replace traditional gas-powered vehicles, which would produce zero tailpipe emissions, leading to a significant reduction in greenhouse gas emissions from transportation.

Recognizing the immense benefits of EVs and lithium-ion batteries, US President Joe Biden has announced plans to ensure that a significant portion of vehicles in the US will be all-electric by 2032, as reported by The New York Times. Additionally, China is also intensifying its efforts to transition to EVs.

Trading Lithium Carbonate Futures

Due to the growing importance of Lithium Carbonate, several exchanges now offer Lithium Carbonate Futures for traders. Traders can access Lithium Carbonate Futures on the Singapore Exchange (SGX) and the newly added Guangzhou Futures Exchange (GFEX) through Orient Futures International Singapore.

SGX offers FM Lithium Carbonate CIF CJK (Battery Grade) LIC/LICF futures contracts, allowing traders to engage in price discovery and hedging opportunities within the lithium market. Orient Futures Singapore is currently a member of SGX, making it more convenient for traders to participate in futures and options trading on the exchange.

In addition to Lithium Carbonate Futures, SGX offers a range of other EV Metals futures, including SGX FM Lithium Hydroxide Futures CIF CJK (Battery Grade) Futures. They also provide various other futures contracts, such as SGX Rubber Futures, SGX USD CNH Futures, SGX MSCI Climate Action Index Futures, and more.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.