SGX Nikkei Suite of Products

With the effects of climate change becoming increasingly pronounced, the call for global efforts to veer the path away from worsening conditions has become an urgency. As one of the leading figures in the financial industry, SGX spearheads the frameworks for financial reporting of sustainability reports, which consider environmental, social and governance factors (ESG).

To complement their efforts, recent product launches from the exchange are also geared towards environmentally friendly options such as energy metals for electric vehicles. Next, on 20 March 2023, SGX has announced the launch of the next product in the suite of ESG and climate space, which is the SGX Nikkei 225 Climate PAB Futures.

The futures is the world’s first climate futures based on Nikkei 225, an index that follows one of the closest barometers of the Japanese stock market.

Why Trade in Climate Indexes?

Undeniably, the significance of different forms of Climate Indexes are to monitor and manage environmental risks such as global warming or sea levels rising. It also supports a range of functions relating to the financial and environmental markets such as policy decisions, supporting research, and raising public awareness.

For traders, climate indexes offer a way of diversification in portfolios. With climate indexes being a newer product, traders that enter the market early are also likely to find new investment opportunities in sectors such as renewable energy, carbon trading and climate adaptation and mitigation technology.

Specifically, for the SGX Nikkei Climate PAB Futures, some of the advantages of trading the products include:

- Maintaining risk/return characteristics of Nikkei 225,

- Low tracking error to Nikkei 225,

- Cross margin benefit with other SGX derivatives and,

- Round-the-clock trading every day except on New Year’s Day.

Generally, the high volatility of climate-linked assets may also offer the potential for higher returns for traders with the appropriate risk tolerance.

About Nikkei 225 Climate PAB Futures

Based on the Paris Aligned Benchmarks (PAB), the new Nikkei 225 futures is made up of component stocks of Japan’s benchmark Nikkei 225 to meet climate goals as well as to address rising investor appetite for climate-related products.

The Tokyo-based benchmark is part of a suite of three PAB regional indices developed by Nikkei, Hong Kong Hang Seng Indexes and Wilshire. Additionally, for Nikkei 225 Climate PAB Futures, the index construction is adjusted by GHG emissions while maintaining sector neutrality.

To ensure the contract reflects the intended underlying index, constituent screenings will identify 3 main factors before listing.

1) If the firm is involved in activities related to controversial weapons, tobacco.

2) If there are any violations of United Global Compact (UNGC) Principles or Organization. For Economic Cooperation and Development (OECD) guidelines.

3) If Revenue derived from coal ≥ 1%; Oil Fuel ≥ 10%, Natural Gas and Electricity Generation ≥ 50%.

Subsequently, the index is set up such that there will be certain exclusion of companies, and re-weighting of constituents so that its overall GHG of the index is 50% lower than that of the Nikkei225 and will be further decreased by 7% in the following years. The top 5 constituents of the index as of March 2023 are Fast Retailing Co., Ltd, Tokyo Electron Ltd, Softbank Group Corp, Advantest Group, KDDI Corp.

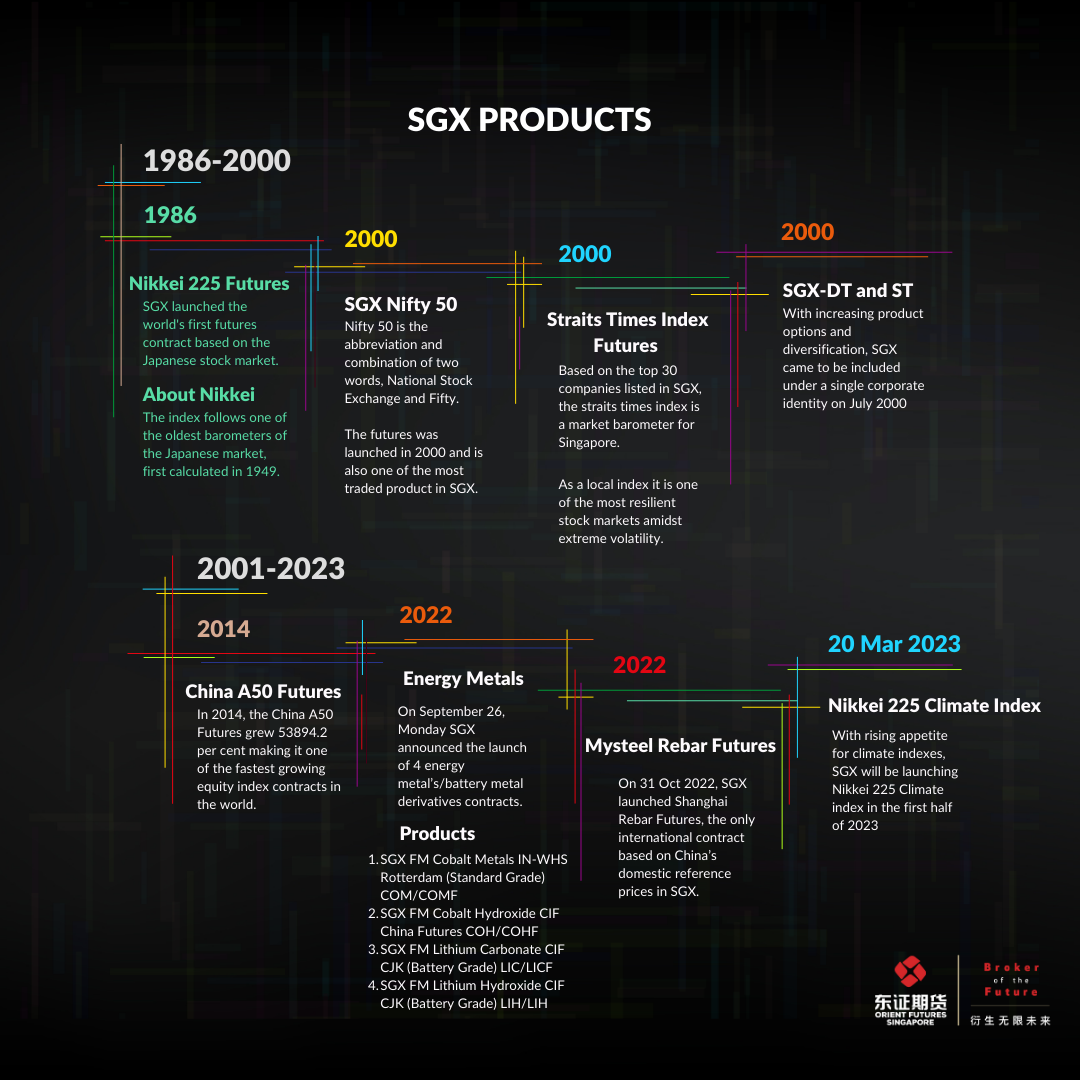

As one of the first futures launched on SGX, Nikkei 225 Futures is one of the most established and oldest barometers of the Japanese market. Traders can also find a timeline of the most traded exchange products in the following diagram.

Source: Orient Futures Singapore: Popular Products on SGX

SGX Nikkei 225 Climate Index PAB Futures Contract

The Nikkei 225 Climate Index PAB Futures has the following specifications:

The contract size for the Nikkei 225 Climate Index PAB Futures is ¥250 x SGX Nikkei 225 Climate PAB Futures price ≈ ¥6,500,000* (~US$50,000) (*Assuming futures price of 26,000), with a minimum price fluctuation of 2.5 index points outright (¥625) or 1 index point for calendar spreads (¥250).

Contract months for the 6 nearest serial months and 32 nearest quarterly months (8 years) on the Mar, Jun, Sep, Dec cycle.

Trading Hours are from Sunday to Friday, at these trading hours:

T Session: 7:30 am – 2:25 pm

T + 1 Session : 2:55pm – 5:15am

The final settlement price of The Nikkei 225 Climate Change 1.5°C Target Index Special Quotation will be based on the opening prices of each component issued in the Nikkei 225 Climate Change 1.5°C Target Index on the business day following the Last Trading Day.

SGX Climate Impact X

For Traders that are exploring the ESG, environmental and carbon markets, SGX also offers a platform for the trading carbon credits through its Climate Impact X project. Through the platform, traders can access to cap and trade schemes, emissions trading schemes or other forms of trading that are aimed to reduce carbon emission.

Market News

As of March 2023, asia.nikkei reports that the collapse of U.S lenders Silicon Valley Bank and Signature Bank widened overnight, despite government efforts to shore up confidence. Heavy selling hit U.S regional bank stocks and traders raced headlong from bets on U.S rate hikes. Nikkei fell 2% while the Tokyo Exchange saw a 7.4% fall in early trade.

Alternatively, on Kyodonews, the fall was also reported as the “biggest one-day point fall in 3 months”. While the news was detrimental to the Nikkei Index, Xinhua News documents that Japanese Economical Minister Shingeyuki Goto continues to express confidence in Japan’s banking system. He reiterates that he was confident that the “financial system is relatively stable”

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.