Nickel is a metal widely used in various industries, including stainless steel production, lithium-ion batteries, and battery electronics. Apart from Cobalt Metal, Nickel is also a critical ingredient used in electric vehicle batteries due to its high energy density.

Thus, its price can be subjected to fluctuations due to changes in supply and demand, geopolitical factors, and other market dynamics.

Currently, these contracts are traded on commodity exchanges, such as the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

To provide more details about Nickel, this article will cover the contract specifications, recent events, and the Nickel industry.

Contract Specifications

The SHFE Nickel Futures Contract has the following specifications:

The contract size for Nickel Futures Contract has a minimum price fluctuation of CNY 10/metric ton with a minimum trading margin of 5% of the contract value.

The last trading day is the 15th day of the contract month. (Postponed accordingly if it is a legal holiday in China and subject to separate adjustment if it falls in the Spring Festival month or another month specifically designated by the Exchange).

This is a monthly contract for the most recent 12 months.

Trading Hours are from 9:00 am – 11:30 am, 1:30 pm – 3:00 pm, and other hours specified by the Exchange (Beijing Time).

Nickel Futures symbol: Ni

Supply Side

The global production of nickel laterite is expected to increase, while the production of nickel sulphide is expected to decrease, but the rate of decline is expected to slow down in 2022-2023. It is expected that the proportion of different types of nickel ores being mined is expected to shift in the future.

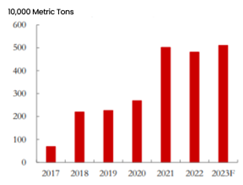

Indonesia is becoming a pivotal country in global electric vehicle (EV) production. Its mining and metallurgical industry is currently in an expansion phase. From Reuters, it is mentioned that the global nickel market is facing a massive supply glut this year as surging Indonesian production continues to outpace global demand.

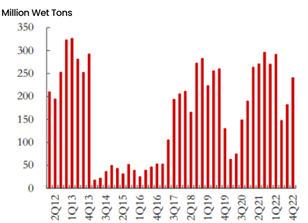

Figure 1:Indonesian Mining Company Antam’s Nickel Ore Shipments Changes

Figure 2:Year-on-year Comparison for Indonesia’s Crude Steel Production

Additionally, apart from Indonesia the shipment volume of nickel in the world’s second-largest producer of nickel is the Philippines. The country is expected to decrease in production by 11% in 2022 due to extreme weather, declining demand, and rising costs. The decrease in the Philippines’ nickel production could also potentially affect the global supply of nickel.

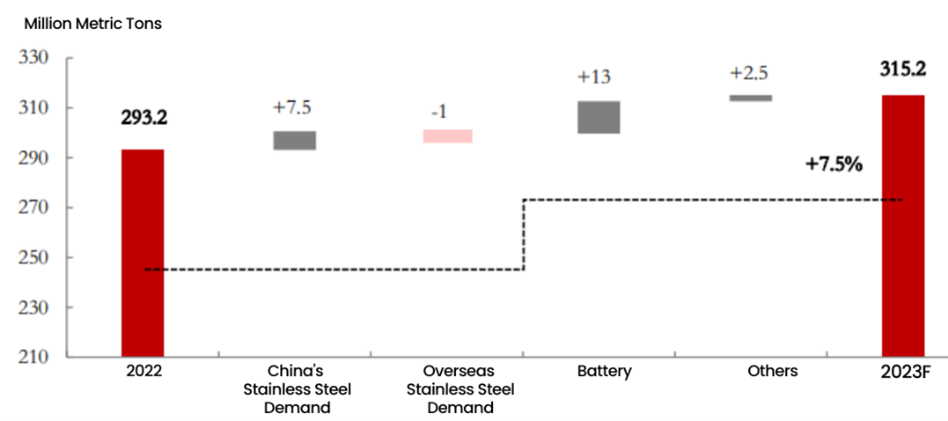

Stainless steel factories in Europe and America are facing dual pressure of declining profits and production, coupled with the increase in Indonesia’s nickel production and the decrease in Europe’s nickel production, the expected marginal reduction of stainless steel production in 2023 is predicted to be less than 500,000 tons. An oversupplied nickel market has put prices under pressure, for instance, LME nickel dipped 0.4% to $23,040 on March 15, 2023, and SHFE nickel remained rangebound on May 9, 2023.

– Shanghai Orient Research Institute, report on Nickel Q2 Outlook and Strategy 04.03.23

Demand Side

According to the IEA’s annual Global Electric Vehicle Outlook, electric vehicle sales are expected to grow by another 35% this year to reach 14 million. With the exploding demand for electric vehicles comes the demand for nickel. For example, Bosch Group is investing 1.5 billion dollars to expand US production for electric vehicle chips. The global chip shortage may be over by 2024 and electric vehicle production and demand are expected to increase.

Additionally, revamped policies targeting EV purchases and the improved charging infrastructure for EVs by the Chinese government may invoke demand for electric cars locally.

However, the marginal growth for global energy vehicle sales is forecasted to be lower than 3.5 million units, whereas the global primary nickel demand is expected to increase by 7.5% to 3.152 million metric tons.

– Shanghai Orient Research Institute, report on Nickel Q2 Outlook and Strategy 04.03.23

Market News

From the EU, Fastmarkets reports that the EU has “already laid out plans to introduce the Carbon Border Adjustment Mechanism (CBAM) with the intention of ensuring that imported products such as steel and aluminium meet environmental standards…” However, these metals does not include all base metals and more has to be done to level the playing field and reduce CO2 emissions.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.