About Soybean Futures

Soybean is a versatile and widely traded agricultural commodity that is used for a variety of purposes, including as a source of protein for both human and animal consumption, as well as for industrial applications such as biofuels and plastics. Two of the major futures exchanges where soybean is traded are the Dalian Commodity Exchange (DCE) in China and the Chicago Board of Trade (CBOT) in the United States.

To provide additional information about the fundamentals, market outlook, as well as the prices of soybeans from each exchange, the following are links to the Soybean article series.

What Are Soybean Futures

Soybean from Dalian Commodity Exchange

6 Things You Need To Know About Soybean Futures Trading

DCE launches Soybean Internationalised Products

Soybean and Palm Oil Reports 2023

With the extensive coverage of soybean futures products in China, this article will predominantly cover the specifics of Cbot’s soybean and the accompanying regulations.

From Investing.com, it was reported that on Tuesday, 22 Nov, at 10:59 ET (15:29 GMT), the Dow Jones Industrial Average rose 271 points or 0.8%, while the S&P rose 0.7% and the NASDAQ Composite rose 0.3%.

On Thursday, Barron’s also reports that the Dow Jones Industrial Average rose 70 points or 0.2% after the index closed 95 points higher on Wednesday, 23 Nov, at 34, 194. S&P 500 futures ticked up 0.3% with futures for the tech stock-heavy Nasdaq climbing 0.4%.

Overall, US stocks and futures rose during the week.

Simultaneously, investors continue to place their focus on the macro backdrop and future of central bank policies. FED’s four consecutive 75 basis rate hikes have proven to be central to economic objectives while affecting the financial market. At November’s board meeting, the Federal Open Market Committee (FOMC) pointed towards the smaller rate hikes coming.

In response to the news and rise in stocks over the week, analysts from Goldman Sachs forecast that investors may have to cope with a lingering bear market. The company also categorizes the current situation as a downturn of cyclical variety, which typically lasts 26 months and takes 50 months for stocks to recover.

Regardless, the fundamentals and outlook of the economy remain uncertain as investors may choose to dial back on the number of rate hikes they’re expecting while others may find the moment opportune for investments and long-term strategies.

Every September, CBOT or the CME group announce changes to location differentials in the Soybean Oil and Soybean Meal futures contracts. This annual adjustment mechanism serves as a way to keep futures delivery differentials in line with cash market prices, relative to the par delivery location. It is also mentioned that the annual adjustment mechanism only triggers if the cumulative weekly average of outstanding shipping certificates is not public. Nonetheless, outstanding shipping certificate can be tracked by Deliverable Commodities Under Registration.

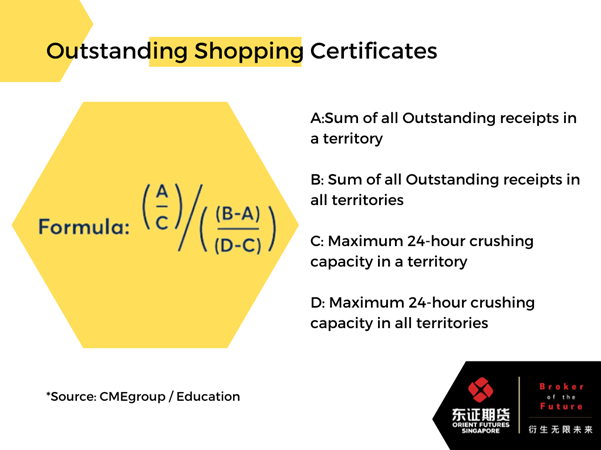

The formula to calculate the ratio between outstanding receipts and crushing capacity is as follows.

Figure 1: Source: CME Group

With the above calculations, CBOT calculates the ratio of outstanding shopping certificates in each territory relative to the same ratio for the combined remaining territories. This methodology rebalances differentials so that the number of outstanding shipping certificates relative to the production capacity will be roughly equal across all territories.

In general, if the ratio is low, deliveries will receive a premium in the next January update, if the ratio is high, deliveries from the territory will receive a discount in the next January update.

CBOT Soybean Futures Contracts

The Soybean Futures contracts has the following specifications:

The Soybean Futures Contract has a minimum price fluctuation of ¼ of one cent (0.0025) per bushel which is = $12.50.

The last delivery date of the good is on the second business day following the last trading day of the delivery month.

Contract months are for 15 monthly contracts of Jan, Mar, May, Aug, Sep and 8 monthly contracts of Jul and Nov listed annually after the termination of trading in the November contract of the current year.

Trading Hours for CME Globex are from Monday to Friday, at these trading hours:

8:30 am – 1:20 pm CT

Or Sunday to Friday:

7:00 pm – 7:45 am CT

Soybean Futures Contracts Code,

CME Globex: ZS

CME Clearport: S

Clearing: S

TAS: SBT

Market News

As indicated in the Ag Intel Market Recap on 27 February 2023, for the fourth consecutive session Soybean futures ended lower with the May contract settling Monday at 1512’6, dropping by 6’4. Across all maturities, volume was 242,013, with the May contract seeing 127,314 change hands.

Similarly, Barchart has also recorded that the first trade day of the new week ended with a 10 ¾ drop in March ahead of the delivery process. The other front months were fractional to 7-cent losses. To track the real time value of the contract, refer to the bar chart diagram here.

As measured by SVL, implied volatility closed the session moderately higher, up by 0.23 to finish the day at 14.66. Historical volatility (30-day) ended at 13.29%, lower by 0.85% to a twelve-year low.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.