About Gold Futures

Gold holds a distinguished status as one of the most coveted metals, revered for its inherent value and reputation as a secure haven asset. Its association with wealth and stability makes investing in gold an enduring and favoured investment option among traders and central banks globally.

Being one of the most valuable metals in the world, many different exchanges offer Gold Futures Contracts, ranging from Gold Perpetual Futures Contract to Micro Gold futures and E-mini Gold futures.

The Asia Pacific Exchange is one of the exchanges that offers Gold Perpetual Futures. Other exchanges that also offer gold futures are New York Mercantile Exchange Comex Division (COMEX), Dubai Gold and Commodities Exchange (DGCX), Osaka Exchange Incorporated (JPX), and Thailand Futures Exchange (TFEX).

To better navigate the complexities of gold futures trading, traders need to have a thorough understanding of the different gold futures contracts. This article serves to inform traders on all they must know about APEX Gold Perpetual Futures in the futures market.

Find out more about Gold Futures here:

5 Things To Know About Gold Futures

3 Factors That Affect Gold Prices

Asia Pacific Exchange

Founded in 2018, the Asia Pacific Exchange (APEX) has swiftly emerged as a pivotal player in the financial landscape of the Asia-Pacific region. It is a Derivatives Exchange regulated by the Monetary Authority of Singapore (MAS).

APEX is the third derivatives exchange with the “Approved Exchange” license in Singapore after Singapore Exchange Derivatives Trading Limited and ICE Futures Singapore Pte. Ltd.

APEX offers a wide array of products spanning commodities, currencies (forex), precious metals and even cryptocurrencies such as Bitcoin Perpetual Futures.

APEX offers different Precious Metals futures contracts, including Gold Perpetual Futures in various sizes (Grams, 1 Troy Ounce, 10 Troy Ounce and 100 Troy Ounce) and also Silver Perpetual Futures.

Gold Perpetual Futures

Being one of the most actively traded futures contracts, APEX offers Gold Perpetual Futures Contracts in various sizes for the convenience and flexibility of investors and traders. Here is the list of Gold Perpetual Futures offered by APEX:

- Gold Perpetual Futures

- Gold 1 Troy Ounce Perpetual Futures

- Gold 10 Troy Ounce Perpetual Futures

- Gold 100 Troy Ounce Perpetual Futures

APEX Perpetual Gold Futures Contract Specifications

The APEX Perpetual Gold Futures Contract has the following specifications:

The Futures Contract has a minimum price fluctuation of US $0.10/troy ounce.

The last trading day of the contract month is not applicable as there is no maturity date.

APEX Perpetual Gold Futures symbol: AUP1/ AUP10/ AUP100

APEX Trading Hours are as follows (LBMA Gold Price AM Publication Day):

T Session:

06:55hr - 06:59hr (Pre-opening Session)

06:59hr - 07:00hr (Opening Match Session)

07:00hr - 18:00hr (Day Session)

T+1 Session:

20:25hr - 20:29hr (Pre-opening Session)

20:29hr - 20:30hr (Opening Match Session)

20:30hr - 05:00hr (Night Session)

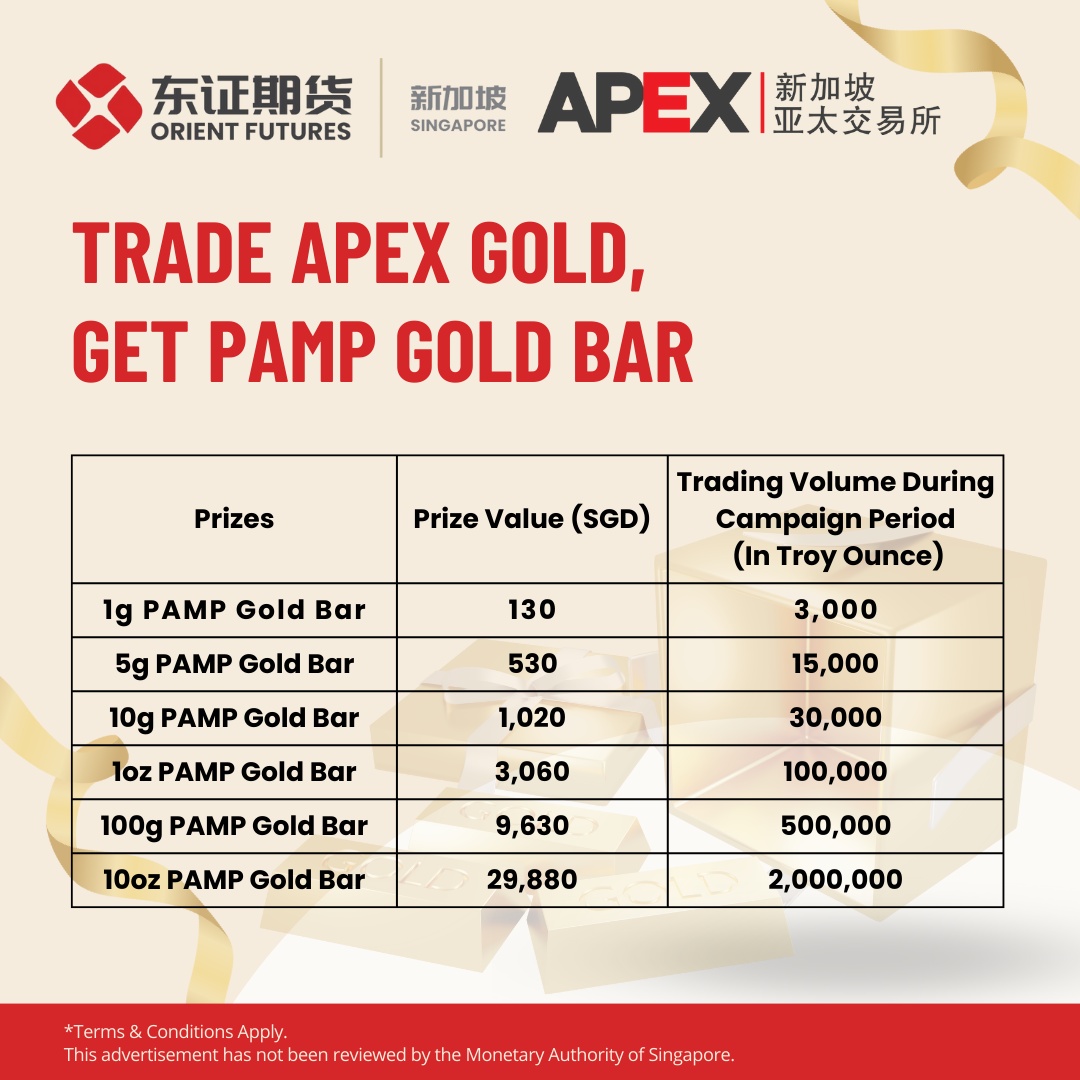

Trade Gold For Gold with APEX Gold Perpetual Futures

From 1st April to 28th June 2024, clients who trade the minimum volume a qualifying amount of Gold Perpetual Futures on the Asia Pacific Exchange (APEX) through Orient Futures Singapore, will be able to receive a PAMP Gold Bar. *

Please note that only the contract codes in Table 1 below are eligible for the Campaign:

|

Contract code |

Contract description |

|

Gold 1 Troy Ounce Perpetual Futures |

|

|

Gold 10 Troy Ounce Perpetual Futures |

|

|

Gold 100 Troy Ounce Perpetual Futures |

Table 1: Eligible contract codes

Please refer to the table below for qualifying amounts:

Click here to start trading to win Gold now!

Orient Futures Singapore Holds Membership to APEX

Since 18th December 2019, Orient Futures Singapore became a clearing member of APEX Asia Pacific Exchange. Being a clearing member of APEX makes trading Gold Futures more accessible to clients of Orient Futures Singapore.

Traders can trade APEX Perpetual Gold Futures through Orient Futures Singapore, a reputable broker based in Singapore.

Orient Futures Singapore is an expert investor Singapore broker and a Monetary Authority of Singapore MAS regulated forex broker. Trading with a regulated broker is crucial as it helps prevent unsuspecting traders from falling victim to forex trading scams perpetrated by unscrupulous companies.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.