What is BAKKT Bitcoin

BAKKT Bitcoin is a service by the International Continental Exchange (ICE) that stores Bitcoin in cold storage. Though it was initially owned by the exchange. In October 2022, it was remade into an equity method investment of ICE, and it was announced that BAKKT will also acquire the crypto trading platform Apex Crypto.

In addition to its function as a crypto exchange or a cold wallet/storage, BAKKT Bitcoin allows users to buy, sell or hold cryptocurrencies.

As one of the products, Orient Futures Singapore offers BAKKT® Bitcoin (USD) Cash settled Monthly Futures from ICE Singapore (ICE SG).

To understand more about this monthly futures, this article will elaborate on BAKKT as an exchange and information regarding the product.

Is BAKKT a Crypto Exchange

Bakkt is a New York Stock Exchange, however, the company is multi-faceted, and its services include being a cryptocurrency wallet and cryptocurrency exchange.

Alternatively, the company is also known as Bakkt Holding and its suite of services includes crypto connect, crypto custody, crypto payouts, and rewards.

While it has acquired the digital asset platform Apex Crypto, the platform is expected to close in the first half of 2023. Additionally, based on the news reporting site Seekingalpha, “Bakkt (BKKT) disclosed last month that it has no exposure to Sam Bankman-Fried’s crypto empire, which filed for bankruptcy on November 11, as well as some of the firms that suffered from the FTX Alameda collapse.”

Apart from these changes, ICE Singapore’s launch of the Bakkt Bitcoin cash settled monthly futures in 2019 opened an avenue for investors to hedge exposure in bitcoin while maintaining a safe environment for the trading of bitcoin.

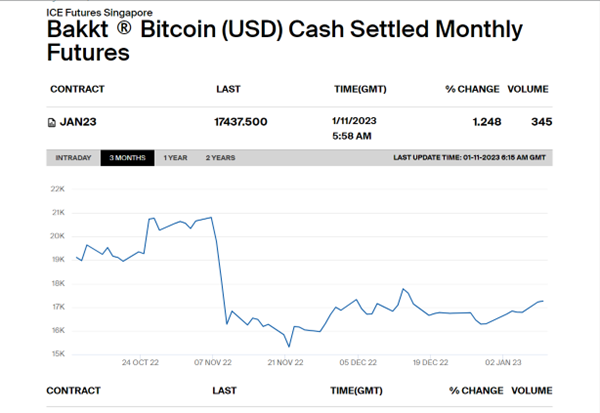

Figure 1: Source: ICE SG , Bakt Bitcoin Index Monthly Futures Contract

Attached above is the real-time price chart offered by ICE SG which indicates the price of the monthly futures for the past 3 months.

How To Invest in BAKKT

To invest in Bakkt, clients and institutional traders can approach brokers that are able to access these futures products. Others may also choose to invest in more conventional forms such as Bakkt stocks or Bakkt shares.

For the trading of futures, Orient Futures Singapore is a brokerage as well as a member of ICE Singapore, this will allow for direct clearing access for the product. Moreover, with inbuilt processes and management, clients will be able to trade funds securely.

For the trading of other forms of stocks of bakkt holdings inc or the bakkt stock price, traders can refer to other sites such as MarketWatch as well as the relevant stock brokerages.

BAKKT Bitcoin Contract Specifications

The Bakkt Bitcoin Monthly Futures Contract has the following specifications:

The contract size for the Bakkt Bitcoin Futures Contract is 1 Bitcoin, with a minimum price fluctuation of $2.50 per bitcoin /contract, and a minimum block trade of 10 lots.

The last trading day of the contract month is 2:30 PM Eastern Prevailing Time (EPT) on the same day on which the equivalent IFUS Bakkt Bitcoin(USD) Monthly Futures Contract expires.

Contract months are up to 12 consecutive contract months.

Trading Hours are from Monday to Friday, at these trading hours:

9:00 am – 07:00 am (Singapore time sgt)

BAKKT Bitcoin Contract Symbol: BMC

Market News

Driven by the crash of FTX and the diminished confidence of institutional investors and retail traders alike, the digital market has seen a volatile rise and crash in 2022. In that year, the world economic forum records that more than $2 trillion in largely speculative market value evaporated. It served as an important lesson about risks and opportunities when trading in the digital space, as well as other forms of investment such as bonds, etc.

Therefore, in 2023, one of the key changes that are expected Is increased regulatory clarity, infrastructure, and processes. Within the field, OutlookIndia mentions that WEB3 infrastructure will continue to grow and draw investors’ attention. WEB3 is a concept of decentralization of blockchain technologies.

Secondly, it is expected that the use of Central bank Digital Currency (CBDCS) will enable newer forms of trade agreements, economic value creation, and effective trade systems. These CBDCs can either be wholesale CBDCs, which are like holding reserves, or retail CBDCs, which are government-backed digital currencies used by consumers and businesses.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.