Currency futures, also known as forex or FX futures were introduced at the Chicago Mercantile Exchange in 1972 (currently the CME Group), these futures reflect the changes in the value of one currency against another for the purposes of managing risks or profit opportunities from currency rate fluctuations.

Among the different pairings, the INR and USD pair are often excluded in major exotic currency rankings, though this pairing is widely offered by several exchanges such as Chicago Mercantile Exchange, Hong Kong Futures Exchange, and SGX.

To learn more about INR/USD futures products, this article will cover the contract specifications and recent information regarding both currencies.

What Are the Major FX Pairs?

A major FX pair is any currency pair that includes the U.S. dollar, crosses are any currency pairs that do not include the U.S. dollar, and exotics are significant currencies paired with a currency from a developing country. The most traded pairs for majors are usually the EUR/USD, USD/JPY, GBP/USD, and USD/CHF pairings.

(The forex market, foreign exchanges, and foreign currencies are also explained in “what is forex trading”, refer to this article to find out more about the industry and terms.)

Do Forex Pairs Move Together

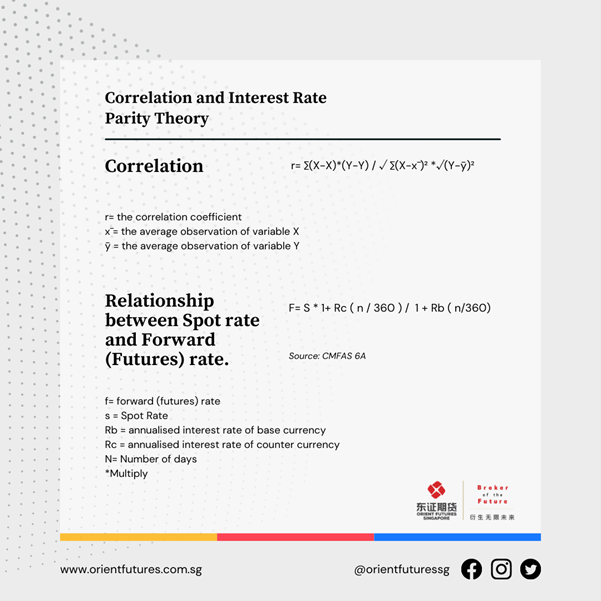

Currency pairs are subjected to market forces and fluctuations, some currency pairs have a tendency of moving together (positive correlation), while others may move in opposite directions (negative correlation). For example, in the USD and INR FX pair, the strengthening of the dollar and the weakening of the rupee may indicate a negative correlation. These negative correlations can also be calculated through the following formula.

Figure 1: Source: Orient Futures Singapore: Correlation and Interest Rate Parity Theory

Additionally, the relationship between the spot rate (current prices) and the futures rate can also be calculated with the second formula. This theory presumes that the premium or discount between two currencies should be equal to the difference in the domestic interest rates for securities of the same maturity. If the interest parity relationship is violated, arbitrageurs can make risk-free profits, which will force futures and spot exchange rates back into alignment.

Most importantly, through correlation and relationship calculations, the risk exposures of these trading pairs should be taken into account. Excessive exposure may adversely affect hedging, leveraging, or strategies to diversify portfolios.

Where to trade FX currencies and how to trade USD and INR?

Orient Futures Singapore enables traders to access FX NDFs when they operate in countries that have non-deliverable currencies. (Such as CNY, TWD, INR, KRW, VRL, IDR, PHP, SGD, CNH). Alternatively, traders can also find G10 currencies in our offerings.

To trade these FX pairings or the USD INR pair, contact us and our team will guide you through the account opening process. Subsequently, before any form of investment, it is paramount that adequate technical analysis, fundamentals, and research are done. Orient Futures Singapore also provides additional resources on the website blog as well as updated research documents to inform traders of the most recent news and market prices.

INR/USD Futures Contract

The INR/USD Futures Contract from SGX has the following specifications:

The contract size for INR/USD is INR 2,000,000, with a minimum price fluctuation of 0.010 US cents per 100 Rupees.

The last trading day of the contract is on the fixing date as specified by participants upon trade registration.

Contract months are 12 monthly as per the underlying futures contract.

Trading Hours are from Monday to Friday, at these trading hours:

T Session:

Pre-Opening: 7.10 am - 7.23 am

Non-Cancel: 7.23 am - 7.25 am

Opening: 7.25 am - 7.30 pm

Pre-Closing: 7.30 pm - 7.34 pm

Non-Cancel: 7.34 pm - 7.35 pm

How is the INR currency doing in 2023?

Based on the November update by SGX insights, the closing out of short SGX INR/USD futures was based on bearish outlooks from India’s weak fundamentals.

From Livemint, it was reported at end of December that the Indian rupee emerged as Asia’s worst-performing currency in 2022, the currency depreciated around 11.5% against the US Dollar on strength in the greenback and capital outflows by foreign investors.

Why is the USD so strong?

The USD is considered one of the strongest currencies and the strong dollar is interlinked to the backing of the U.S. economy and governmental policies. Most recently, the federal reserve is focused on slowing inflation by raising interest rates higher and increasing the cost of borrowing from central banks. (Refer to “FED interest rates hikes while job market show signs of cooling” for updated information).

In addition to the strength of the USD, its position in major currency pairs is critical to assess the impacts of inflation or recessions, for example, the EUR/USD pair kickstarted 2022 with a weak tone, and the pair remains bullish despite struggling to retain gains.

This comparison of the British pound to the US dollar serves as one of the indicators of the economic conditions of the two powerhouses, which gain and fall against one another from inflations and recession as well as a plethora of factors such as the Russian-Ukraine conflict.

INR/USD Pair Forecasts

In mid-2022, SGX reports that the aggregate trading volume for SGX INR/USD Futures in April was over US$38.5 billion, up 6% y-o-y and 2% m-o-m; open interest as of end-April was at US$2.76 billion, up 198% y-o-y and 49% m-o-m, the surge broke OI records and volume.

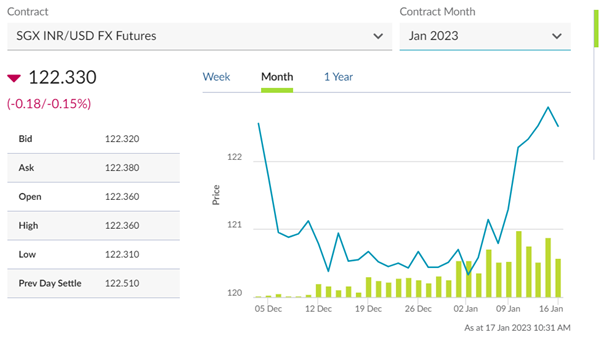

Figure 2:Source:SGX: Jan 2023 INR/USD FX Futures

As of Jan 17, the above price chart is the current pricing for the SGX INR/USD FX futures.

Subsequently, in 2023, sources such as Mint cite a depreciation of the Rupee against the US dollar in H1 2023, while other sources such as Nasdaq similarly portray USD as the stronger dollar as it is mentioned that India’s widening $100 billion trade deficit – will propel further rupee weakness into 2023 and beyond.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.