January to September 2022

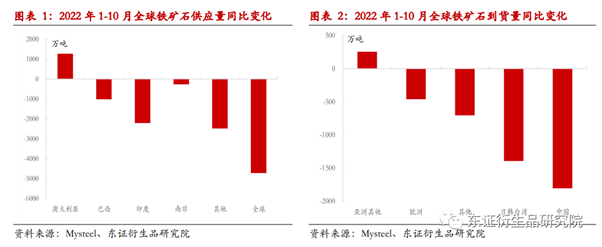

In terms of shipping standards, global iron ore shipments from January to October fell by nearly 50 million tons year-on-year. Most of the reduction in shipment came from non-mainstream countries such as India and Ukraine. Australia’s mainstream mines performed steadily in the third quarter, while Brazil continued to see no growth.

Currently, Rio Tinto is expected to produce 320 million tons in 2022 and plans to slightly increase production to 330 million tons in 2023. FMG’s fiscal year 2023 production target will remain at 187-192 million tons.

In terms of demand, the demand for crude steel is expected to decline by -3.7% in 2022. Similarly, as molten iron fell by about 1% (13 million tonnes in iron ore), downstream steel mills reduced their inventories and on-site-inventory fell by about 17 million tonnes.

From Australia, the commissioning time of the Iron Bridge project has been postponed to Q1 2023, and it will take 12-18 months for the project to fully reach production capacity. If Vale is to complete the annual production plan & inventory reduction target of 310 million tons in the fourth quarter, it is expected that its Q4 shipments will increase significantly from the previous quarter.

Graph 1: Changes in global production of Iron Ore from January to October 2022

Graph 2: Changes in global delivery volume/arrivals of Iron Ore from January to October 2022

From January to October, China’s iron ore imports to Hong Kong decreased by 20 million tons year-on-year. During the same period, iron ore arrivals from Japan, South Korea, Taiwan, and Europe decreased by 14 million tons and 5 million tons respectively.

For China, the impact of mining accidents in Hebei and Shanxi has also decreased the output from domestic mines as well.

Outlook for 2023

Iron Ore Output is Expected to be 32 Million tons

The shrinkage of the iron ore supply in 2022 will mainly come from non-mainstream and domestic mines, and it will be difficult for non-mainstream mine sources to cause more decreases in the iron ore supply in 2023. Mainstream mines such as Australia and Brazil are expected to increase slightly by 25 million in 2023. During the two-year period from 2020 to 2022, affected by the epidemic and safety supervision, domestic (Chinese) mines will continue to fall short of expectations.

Overall, it is estimated that the annual increase in iron ore production in 2023 will be 32 million tons.

Domestic Molten Iron is expected to decline by 3%, and the corresponding cost will remain at 70-80 US dollars/ton

On the demand side, the total domestic steel demand is expected to decline by 2.3% in 2023. While the reduction of crude steel production was mostly caused by the scrap steel industry in 2022, it is likely that in 2023 the hot metal industry will further reduce crude steel production.

If domestic molten iron drops by 3% in 2023, the corresponding annual surplus of iron ore will be about 6800W, the proportion of the supply ratio will be about 4%, and the corresponding cost range is between 70-80 US dollars. Overall, the long-term market sentiment is gradually picking up, but the actual fundamental improvement will only be evident after a long period of time.

December 2022 Market Prices

On December 5th, Reuters reported that iron ore futures rose on Monday after more cities in top steelmaker China eased strict COVID restrictions over the weekend, lifting demand sentiment. From China’s Dalian Commodity Exchange, the January iron ore contract was up 3% at 800.0 yuan ($114.63) a tonne, an increase of 4.1% and highest since June. From the Singapore Exchange, the benchmark December iron ore was up 2.1% at $108.85 a tonne.

On December 12th, iron ore prices hit a 4-month high of $113.5 per tonne, trading economics states that investors weighed on surging Covid cases in top consumer China against hopes that Beijing will pass more stimulus measures to spur economic activity.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.