In the bustling maritime landscape, the Shanghai Containerized Freight Index (SCFI) stands as a beacon, illuminating the fluctuations and trends within the container shipping industry. As we venture into the future, the SCFI continues to play a pivotal role in shaping global trade dynamics and forecasting market movements. In this article, we delve into the current state and future prospects of this crucial index.

INE Shanghai Containerized Freight Index Market News

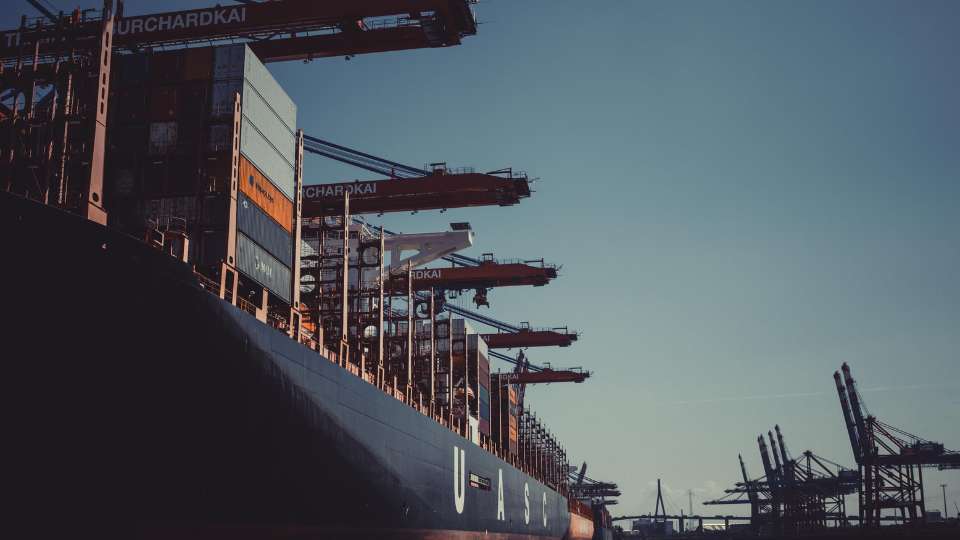

According to a report by NikkeiAsia, many containerships are opting for alternative routes to avoid the conflict-impacted Red Sea. Despite an initial surge, container freight rates are now indicating a trend of moderation. Philip Damas, who serves as the managing director at the British maritime research firm Drewry, informed Nikkei Asia that exporters and shipping firms are progressively adjusting to extended transit durations, strategically organizing and getting ready accordingly.

The Red Sea and Suez Canal serve as critical arteries for the transportation of goods between Asia and Europe. However, the security risks associated with this key maritime route have escalated since November, following a series of attacks on containerships by Houthi militants based in Yemen.

These attacks have raised concerns among shipping companies and international stakeholders about the safety and reliability of the Red Sea route. The strategic significance of the Suez Canal, which provides a vital shortcut between the Indian Ocean and the Mediterranean Sea, further amplifies these concerns.

INE Shanghai Containerized Freight Index Outlook in 2024

According to a report from Baidu on April 4, the Shanghai Shipping Exchange announced that China's export container shipping market remained relatively stable during the recent short holiday period. Variations in supply and demand dynamics led to differing trends across various shipping routes, resulting in a slight increase in the comprehensive index.

S&P Global data revealed that the Caixin China Manufacturing Purchasing Managers Index (PMI) for March climbed to 51.1, marking the fifth consecutive monthly increase and indicating ongoing improvement in the manufacturing sector. This suggests that China's economy is steady and on a positive trajectory, providing long-term support for the country's export container shipping market. On April 3, the Shanghai Export Container Comprehensive Freight Index released by the Shanghai Shipping Exchange was 1,745.43 points, an increase of 0.8% from the previous issue.

INE Shanghai Containerized Freight Index Futures Contracts

According to an announcement on Feb 5, the Shanghai International Energy Exchange (INE) has revealed plans to increase trading limits and revise margin requirements for several of its listed products, including container shipping, oil, copper, and rubber contracts.

For its European container shipping index, the exchange intends to expand the trading band from the previous limit of 20 per cent to 25 per cent. Additionally, the margin ratio will be adjusted upwards from 22 per cent to 25 per cent.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalized futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us.

We provide bespoke services to our professional clients, tailored to their corporate and individual needs. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.