Fundamentals of Domestic (China) Sugar Market

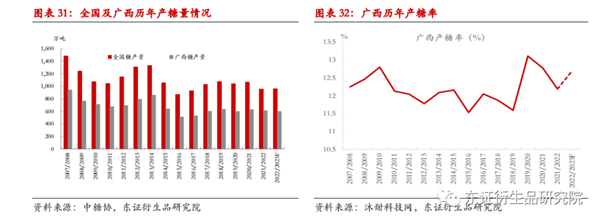

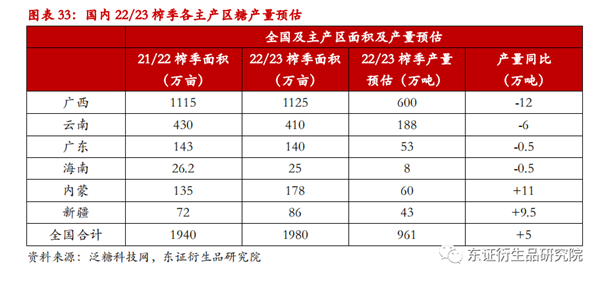

For the 21/22 crushing season, the country produced a total of 9.56 million tons of sugar, with a reduction of 1.1 million tons, of which, beet sugar production contributed to the decrease of 680,000 tons.

For the 22/23 crushing season, the plantation areas for sugarcane in Guangxi will expand slightly. However, the prolonged drought in the region has affected the growth of sugar cane. The average high is much lower than that of the same period last year. Sugarcane production in Guangxi this year is also expected to be lower than previous market expectations.

Mutian Technology Co. Ltd analyzed that Guangxi’s sugar production would be at 5.4-5.7 million tons this season, while Pan Sugar Technology expects the sugar production to be at 6 million tons, both expectations are lower than last year’s 6.12 million tons.

In 2022, the increase in beet prices has restored the planting area for the crop, and it is expected to increase production by about 30% (200,000-300,000 tons). The national sugar production in this crushing season is expected to be around 9.6 million tons, lower than the 10.35 million tons that were estimated by the Ministry of Rural Agriculture.

Costs

For the 22/23 crushing season, the cost of sugar produced in the quarter will remain at a high level, However, dry weather will be conducive to the increase of sugar content. It is expected that the sugar content of sugar cane in Guangxi will increase from 12.19% to 12.5% - 13%. To secure planting areas, northern beet sugar factories have increased the purchase price of beet for the 22/23 season, and some areas have reached a record high. Overall, the purchase price has increased by 50 – 100 yuan/ton year-on-year, and the cost of beet sugar is expected to reach 5,800 – 6,000 yuan/ton.

Figure 31/32: China’s Sugar Production and Guang Xi's Sugar Production, Shanghai Orient Research Institute

Figure 33: Estimated production/planting areas of different regions in China, Shanghai Orient Research Institute

In terms of import costs, ICE (Intercontinental Exchange) raw sugar has remained in the range of 17- 20.5 cents/lb. this year. Due to the continuous aggressive interest rate hikes by the federal reserves, and strict rules to curb the rebound of covid, RMB continued to weaken from 6.3 to 7.3. In addition, the depreciation of the currency has led to an increase in the cost of imports. In the second half of the year, the loss of imports beyond the quota reached more than 1,000 yuan/ton.

Brazil’s sugar market

From Brazil, the sugar mills in the 23/24 crushing season are expected to remain at a high level of around 46% which is largely stable. However, there are two main factors that may affect the outlook for the year.

-

Fuel Tax

Although the fuel tax recovery is expected to bring benefits, the new government may change fuel pricing and re-adopt the fuel price ceiling policy, this will offset the tax recovery. Bullish ethanol prices may remain difficult to predict, and the benefit of sugar cane production may be better than ethanol production.

-

Trend Analysis

In November 2022, the ICE raw sugar July contract and October contract fluctuated around 18 cents. Brazilian sugar mills have achieved good positive returns extending into the 23/24 crushing season. Based on research from Archer Consulting’s survey, Brazil’s 23/24 crop sugar hedging volume reached 9.36 million tons, with an average price of 17.31 cents, accounting for 39% of the expected crop export volume.

Currently, this trend will increase hedging by sugar mills, and Shanghai Orient’s research analysts have observed a sharp increase in commercial short positions on ICE raw sugar futures. In comparison to last year, as of the end of October 2021, Brazilian sugar mills’ sugar hedging for 2022/23 accounted for 43.2% of the total expected exports, which is the second-highest level on record.

It is expected that Brazilian sugar mills in hedging sugar for the 23/24 crushing season will be relatively fast, which will prompt sugar mills to produce sugar.

India’s sugar production

In the 21/22 cropping season, the cropping season broke all the previous records of sugar cane production, sugar production, and sugar export in India. The Indian Sugar Association ISMA records a high of 36 million tons, not including 3.4 million tons of sugar used for the ethanol industry. In contrast, for the last crushing season, India’s sugar production was 31.192 million tons.

For the 22/23 cropping season, India’s production and demand will be affected by the following factors:

-

Acreage and Yield

Sugarcane planting has much higher income and profitability in comparison to other crops, hence, farmers are more enthusiastic about planting sugarcane. ISMA expects that the planting area of sugarcane in India will increase by 4% year-on-year in 22/23. Adding to the profitability, the southwest monsoon period from June to September has abundant rainfall, boosting sugar cane growth as well as the prospects of sugarcane production.

For this crushing season, the average ethanol-gasoline blending rate target in India is raised to 12%, and the amount of sugar entering the ethanol industry is expected to be about 4.5 million tons. Subtracting away the sugar used by the ethanol industry, the actual sugar production for the 22/23 crushing season remains at 35-36.5 million tons. (An increase of 2% year-on-year.)

-

Domestic Demand

Domestic demand in India will likely increase slightly to 27.5 million tons in the 22/23 cropping season, and the domestic demand may still be about 8-9 million tons in surplus. Though India’s sugar inventory declined in 21/22 demand continues to exert pressure to accumulate inventory. India still needs to export a certain amount of sugar in the 22/23 cropping season.

-

Export

Lastly, India has also implemented an export restriction policy. In early November, the Indian government announced the release of the first batch of 6 million tons of sugar export quotas, allowing for its export before May 31, 2023.

As of the end of November, 4-4.3 million export contracts have been signed for the 22/23 crushing season. Overall, higher international sugar prices have given Indian sugar export profit margins, prompting sugar factories to actively sign export contracts. With larger exports, it is expected that the sugar mills will be able to sell all 6 million tons of quota for exports before the end of December.

After March-April, India may announce the second batch of export quotas of 2-3 million tons based on the country’s production and inventory conditions. The total export volume in the 22/23 cropping season is expected to be around 8-9 million tons, although higher than the previous crop, the quarter has decreased.

Outlook and Investment

The first half of the year: For the first half of 2023, the international raw sugar trade flow is expected to be relatively tight, especially in Q1. ICE raw sugar is expected to offer prices somewhere near or above the parity price of Indian sugar exports. The estimated operating range is expected to be 17 – 21 cents/lb. If the announcement of the second batch of export quotas falls short of expectations, market prices are likely to rise.

The second half of the year: For the second half of 2023, when Brazil enters the peak period of sugar crushing, the raw sugar trade flow is expected to turn into a surplus, which in turn will place pressure on ICE raw sugar prices. Considering the production cost of sugar in Brazil and Thailand, the equilibrium piece of ethanol discounted sugar in Brazil and the demand in China, the space below the international sugar price will also be limited. In this period, the overall range of sugar prices is expected to decrease which will place it within the range of 16-18 cents/lb.

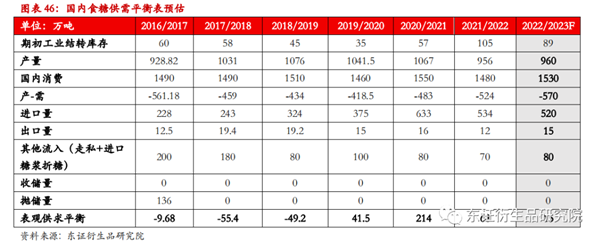

Figure 1: China's Sugar Demand and Supply Balance Sheet estimates: Shanghai Orient Futures

From China: China’s supply and demand of sugar in the 22/23 cropping season are expected to be relatively balanced, which is an improvement from the 21/22 cropping season. Based on the analysis and prediction of the external market in 2023 by Shanghai Orient Futures, the RMB is likely to fluctuate and rise, additionally, the cost of non-quota imports in the first half of the year is likely to exceed the cost of domestic sugar.

In Q1 of 23, around the Spring Festival period (January), demand will be in its off-season from February to March. After the festival, the prices are likely to maintain around the range of 5,500-5,700 yuan/ton. In the late stage of China’s sugar crushing, the number of newly added sugars and the supply of imported sugar on the market are gradually decreasing. Though demand may improve from positive economic expectations, futures prices are expected to fluctuate slightly, with an estimated range of 5,400-5,600 yuan/ton, and the basis may show a premium.

For Q2 of 23, the cost of extra-quota imports is expected to fall below the cost of domestic sugar. Considering that there is a gap between production and demand in China that needs to be filled by imported sugar, the demand for imported sugar will increase, and the profit from imported sugar outside the quota is expected to gradually recover, but it will be difficult to see a large profit margin.

On one hand, Zhengzhou’s sugar is weak, on the other hand, the weakening of the US dollar from the FED’s shift in policy may make the overall atmosphere of commodities more positive, and the estimated range would be 5,000-5,500 yuan/ton.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.